|

BIZCHINA> Top Biz News

|

|

Stocks edge down on slow loan growth concerns

(China Daily/Agencies)

Updated: 2009-08-11 07:57

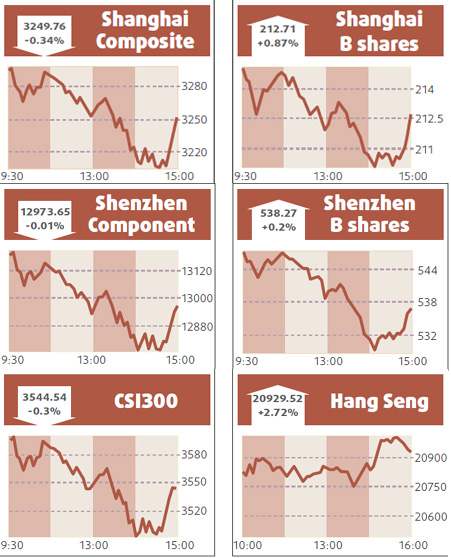

The mainland stocks fell for a fourth day, the Shanghai Composite Index's longest losing streak this year, as financial and energy companies dropped on concern slowing loan growth will crimp margins and curb housing and power demand. The Shanghai Composite declined 10.93, or 0.3 percent, to 3249.76 at the close, capping its longest series of losses since Dec 31. The gauge slumped 4.4 percent last week, its biggest retreat since the five days to Feb 27, on concern the central bank will curb inflows into a stock market that had doubled from last year's low. "There will be problems with liquidity inflows in the second half of the year as it's not possible for new lending to keep expanding as fast as it did in the first half," said Li Jun, a strategist at Central China Securities Holdings Co. The Shanghai Composite is up 78 percent this year, the world's second-best performing benchmark index, as banks tripled new lending to a record 7.37 trillion yuan in the first half from a year earlier and the economy rebounded.

Poly Real Estate, the nation's second-largest developer by market value, dropped 2.5 percent to 25.76 yuan. Gemdale, the No 4, lost 3.2 percent to 16.28 yuan. PetroChina Co lost 1.1 percent to 14.84 yuan. Shanghai Bailian Group Co, the listed unit of China's biggest retailer, advanced 7.6 percent to 14.48 yuan as investors sought stocks that have underperformed the benchmark index. China's stocks aren't in a bubble, Mark Mobius, executive chairman of Templeton Asset Management Ltd, said. The government's policies to rein in bank lending are a "good thing". Hang Seng surges Hong Kong stocks rose, with the benchmark index closing at an 11-month high, after China said it will maintain policies aimed at boosting growth. Aluminum Corp of China Ltd led gains, up by 5.6 percent to HK$9.96. The Hang Seng Index added 2.7 percent to 20929.52, its highest close since Sept 2. The Hang Seng China Enterprises Index advanced 2.5 percent to 11901.65. The Hang Seng Index has soared 84 percent from a four-month low on March 9, amid speculation stimulus efforts worldwide will revive global growth. The measure registered its first weekly loss in a month, shedding 1 percent, last week.

(For more biz stories, please visit Industries)

|