|

BIZCHINA> Top Biz News

|

|

Stocks firm up on higher commodity prices

(Agencies)

Updated: 2009-08-05 07:51

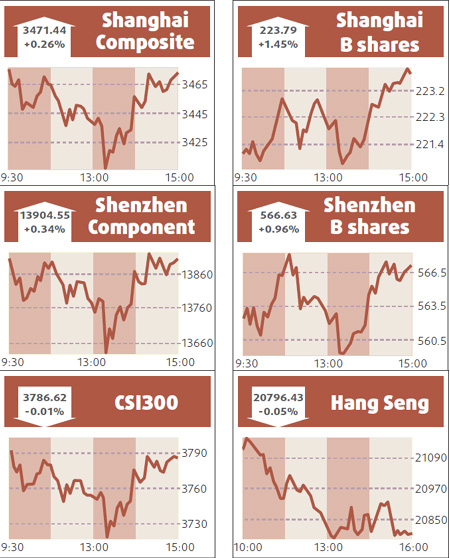

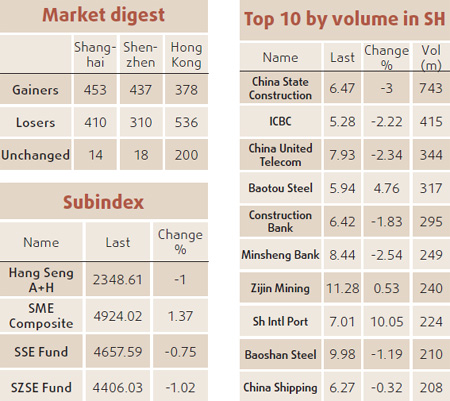

The mainland stocks rose for a fourth day, pushing the benchmark index to its highest level since May 2008, as commodity producers gained on higher oil and metal prices, outpacing declines in banks. The Shanghai Composite Index added 8.85, or 0.3 percent, to 3471.44 after changing direction at least 10 times. The gauge is up 91 percent this year as bank loans tripled in the first half and the government implemented a stimulus plan. Stocks on the index trade at 37.7 times reported earnings, near an 18-month high. The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, was little changed at 3786.61. "The global and domestic economic recovery looks quite strong," said Sun Chao, an analyst at CITIC Securities Co in Shanghai. There are "risks arising from higher valuations and expensive share prices", he said. China Shenhua Energy Co, the nation's largest coal producer, advanced 6.3 percent to 41.19 yuan, the most since June 29. China Coal Energy Co, the nation's second-largest coal producer, rose 3.4 percent to 16.61 yuan. Western Mining climbed 3 percent to 19.73 yuan. Sichuan Hongda Chemical Industry Co, China's third-largest zinc producer, added 4 percent to 24.23 yuan. Industrial and Commercial Bank of China Ltd fell 2.2 percent to 5.28 yuan on concern the government may tighten capital requirements and crimp banks' ability to lend. China Construction Bank Corp, the No 2, retreated 1.8 percent to 6.42 yuan. Daqin Railway Co, the operator of China's biggest coal transport network, climbed 5.5 percent to 11.95 yuan, the biggest gain since March 4. The company had its stock rating raised to "buy" at Shenyin & Wanguo Securities Co, which cited rising demand for power-station coal and a possible asset injection by its parent. Hang Seng flat

Shares in Europe's largest bank jumped 7 percent to finish at a 10-month closing high of HK$83.1, but another UK-based lender, Standard Chartered, dropped 2.3 percent as its forecast-beating earnings were overshadowed by a surprise fundraising plan. The benchmark Hang Seng Index finished 10.83 points lower after opening at a 12-month high of 21196.75. The China Enterprises Index dropped 1.2 percent to 12218.67.

(For more biz stories, please visit Industries)

|