The glory days when Walmart stores drew a rush of more than 80,000 shoppers on the opening day of its first supermarket in China in the 1990s are well and truly gone. Many other foreign supermarket chains have also lost money in the world's most populous country, territory that once seemed to hold the prospect of rich and easy pickings for the top global retailers.

Under a major assault from e-commerce firms, the profit margin of the physical retail market in China fell from 5 percent in 2005 to nearly 2.5 percent last year. Tesco, Carrefour and Walmart have all remained below that benchmark, a Kantar Retail report says.

After two years of testing, Metro AG of Germany said in January it was pulling out of the Chinese consumer-electronics business under the Media Markt brand. Home Depot Inc announced last year that it would shut all seven of its big-box home improvement stores in China.

Earlier, the Southern Metropolis Daily reported last year Carrefour shut two stores and Walmart shut five.

Against a backdrop of declining sales of big foreign retailers last year, Chinese supermarket operators have been aiming high and have had strong performances in recent years.

Yonghui Superstores Co Ltd, the Fujian-based supermarket chain, said earlier that it plans to have 350 stores and 50 billion yuan ($8.1 billion) in sales revenue in China by next year.

In its first-quarter report, net profit attributable to shareholders surged 133.5 percent year-on-year to 276.14 million yuan. Operating revenue for the first three months grew 20.79 percent year-on-year to 7.52 billion yuan.

Liu Hui, chief consultant at the Beijing Uni-Retail Business, says that the last few years have been tough for foreign supermarket chains because of fierce competition from Chinese domestic rivals, which have gained rapidly by drawing on advantages in sourcing and distribution.

"Because of soaring operational costs such as rent and personnel, foreign retailers have been losing money in the market," Liu says. "On the other hand, domestic companies have better weathered the downturn. With subsidies and favorable conditions given by local governments such as better locations and low rent, domestic supermarket chains such as Yonghui and Wumart have been able to promote growth very quickly."

Sun Art, a joint venture between the Ruentex Group of Taiwan and the privately held French retailer Group Auchan SA, now has a 13.6 percent market share in China, generating high profit on its expertise in maintaining competitive prices with local suppliers.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

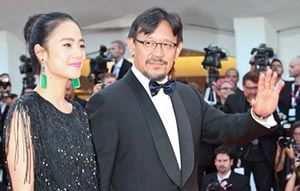

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant