BEIJING -- The net profits of China's banks are expected to grow by 10 percent this year, the China Securities Journal reported Wednesday.

The growth rate, which is smaller than those of previous years, must be achieved by cutting the provision coverage ratio, the paper said.

The banks' non-performing loan balances and ratios will both trend upwards, posing risks for their future performance, the paper quoted Lian Ping, chief economist at the Bank of Communications, as saying.

Liu Yuhui, an economist at the Chinese Academy of Social Sciences, was cited as saying that the banks are not likely to fully expose risks and unveil all of their non-performing loans, provided that the heads of the banks remain in charge.

Data from the China Banking Regulatory Commission showed that China's total bank assets reached 140 trillion yuan ($22.65 trillion) as of the end of May, up 16.3 percent year on year.

The non-performing loan ratio for commercial banks stood at 1.03 percent, topping 1 percent for the first time since last year. Provision coverage reached as high as 280 percent, according to the report.

"The non-performing loan ratio is expected to rise in the second half of this year, but is not likely to go beyond 1.5 percent," Lian said.

Cutting provision coverage may help the banks in the short-term, but there is no leeway for the banks to continue to do so next year, Liu said.

Eleven of China's 16 listed banks have already cut their provision coverage ratios, according to the banks' first-quarter reports.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

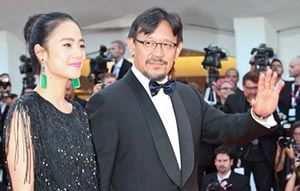

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant