China has the second-largest number of companies on the 2012 Fortune Global 500 list of the world's biggest companies by revenue, and energy and financial giants remain dominant, but private enterprises are quickly catching up.

The annual ranking showed that China has 73 companies on the list, overtaking Japan's 68, and was only behind the United States, which has 132 companies on the list, according to Fortune magazine.

"There will be more Chinese companies on the list if the country's economy could achieve its 7.5 percent growth target this year," the magazine said.

China's runner-up place this year was secured with the addition of 12 companies to the prestigious list, the ninth consecutive year China's position has risen, while the number of US companies has declined for the 10th year, having one fewer than the previous year.

The number of European companies fell to 161 from 172 on last year's list.

"Despite the financial turmoil in Europe and disasters in Japan, the world's largest corporations had record profits and revenues in 2011," Fortune's statement said.

In total, the Global 500 companies posted record revenues of $29.5 trillion, up 13.2 percent over 2010, with total profits rising 7 percent to $1.6 trillion.

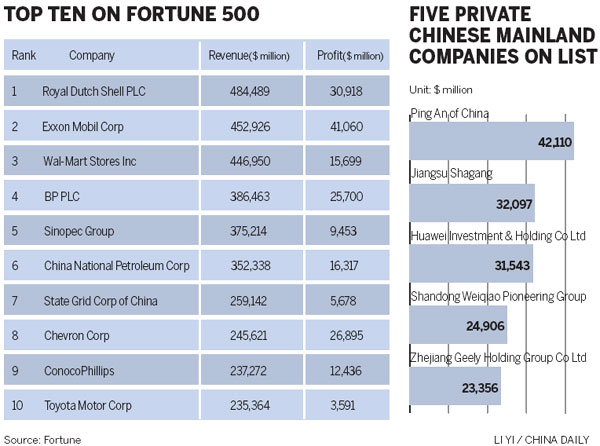

The UK-Dutch energy giant Royal Dutch Shell PLC retook the top spot this year, with $484.5 billion in revenues in 2011, up 28.1 percent from 2010, knocking the US retail titan Wal-Mart Stores Inc from first place after two years at the top.

Eight energy businesses dominated the top 10, including three Chinese companies - Sinopec Group, China National Petroleum Corp and State Grid Corp of China - whose rankings remained unchanged from the previous year.

The Taipei-based Hon Hai Precision Industry Co Ltd, also known as Foxconn, an electronics maker and major supplier for Apple Inc, ranked 43rd on the list. In contrast, the California-based tech giant was 55th on the list, up 56 places from the previous year.

China National Building Materials Group Corp, which ranked 365th, was the biggest climber among Chinese companies, rising 120 places.

Chinese banks' rankings have also improved significantly, with the Industrial & Commercial Bank of China Ltd, China Construction Bank Corp, Agricultural Bank of China Ltd and Bank of China Ltd forming the second tier of Chinese companies on the list. The ranking of each bank rose by 20 to 40 places.

However, Wang Yaoji, deputy director of the Securities Research Institute of Fudan University, said Chinese banks gained their profits mainly through high interest differentials between loans and deposits. According to the data from the China Banking Regulatory Commission, interest rates accounted for 66 percent of the income of Chinese banks, "thus the high revenue doesn't represent the profitability of these monopolized financial giants", Wang said.

Guo Tianyong, director of the Research Center of the Chinese Banking Industry at the Central University of Finance and Economics, warned that "as China gradually promotes market-oriented interest rate reform, Chinese banks will face increasing pressure on their profit margins".

Although most Chinese companies on the Fortune 500 list remain large State-owned enterprises, privately owned companies also performed well in the latest fiscal year.

There are five such private enterprises on the list. Ping An Insurance Group Co of China Ltd ranked the highest at 242nd, and the textile company Shandong Weiqiao Pioneering Group and the automaker Zhejiang Geely Holding Group made their debut.

"The number of companies on the list reflects the economic strength and competitiveness of a country and the increasing number of Chinese companies is to some extent linked to the strong growth of the economy," Zhou Zhanhong, assistant editor-in-chief of Fortune China, told the Chinese newspaper The Mirror.

However, Zhou said, "most of the Chinese companies gain their profits mainly in the domestic market and are not globally competitive, thus they could leave the list in the event of an economic slowdown".

Sinosteel Corp, the country's second-largest importer of iron ore, was the only Chinese company to leave the list, following the dismissal of senior executives amid a financial scandal.

Wang Zhile, director of Beijing New Century Academy on Transnational Corporations, said although some Chinese companies have surpassed traditional multinational companies in scale, they still cannot be regarded as global enterprises.

"There is still a long way to go for Chinese companies to be globally recognized," Wang said.

But local governments have already issued supportive policies for companies with the ambition to do so.

Guangzhou, the capital of Guangdong province, recently launched an incentive program including 20 million yuan ($3.14 million) in subsidies for local companies that join the Fortune Global 500, and 3 million yuan for those who remain on the list for three consecutive years.

weitian@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions