Gifford says he is especially keen to find out about what is permitted in the zone for bank financing and lending - and how that connects to the rest of China.

Banks setting up in this zone would want to extend their increased financing and lending capacity to activities outside the zone, which is otherwise limited, he says. "So how much can you lend and in what way can you lend?"

Whatever the regulatory details, he supports the zone "because it will be under international rule and it will allow more freedom of access and freedom of activity".

Another highlight of Gifford's China visit was attending the launch ceremony for the Shanghai office of London's bulk shipping exchange, the Baltic Exchange.

The exchange is already well known in China as the publisher of the daily Baltic Dry Index, which assesses the price of moving major raw materials by sea. It is used by many major Chinese commodity importers.

"The Baltic is the world's most reliable exchange. I think the opening of their Shanghai office is significant as it extends global maritime standards to China," he says.

It will also attract more Chinese shipping companies to join the exchange, helping them access global shipping markets more readily.

"To international shipping companies, it means greater facilitation, and greater knowledge, which helps people who want to buy and sell," he says. "It also helps the new Chinese members to be more international, because it acts as a mark of their quality."

Gifford also witnessed the expansion in China of the London Metal Exchange, which Hong Kong Exchanges and Clearing bought last year.

"(The acquisition) clearly means greater influence of Chinese companies on the London Metal Exchange - and that's great, because China is a major metal purchaser and seller," he says.

Gifford says an essential part of the Chinese financial industry's opening-up is the internationalization of the country's institutions. Having five Chinese banks gathered in London clearly represents progress.

"These banks learn a lot about international banking standards, which they can then bring back to China. This may relate to lending, credit cards, bond markets, foreign exchange, or whatever. So this process is one of harmonizing standards."

At the same time, he says, Chinese banks also contribute a lot to London through employment and tax, as well as helping to facilitate bilateral trade and investment between China and the UK.

They also help London's efforts to develop an offshore yuan market through educating businesses about how they can invoice trade transactions in the Chinese currency.

Asia Bike Trade Show kicks off in Nanjing

Asia Bike Trade Show kicks off in Nanjing

Student makes race car for 4th Formula SAE of China

Student makes race car for 4th Formula SAE of China

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

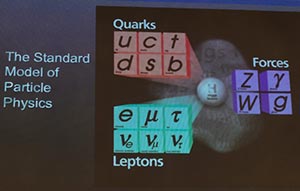

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists