|

|

|

|

|||||||||

|

China was the second-largest investment destination last year for Intel Capital, the investment arm of the chipmaker Intel Corp, following the United States, with 12 percent of its investment going to the Asian nation. [Photo / Bloomberg] |

Intel Capital, the global investment arm of chipmaker Intel Corp, said it hopes to keep the pace of investment in the Chinese mainland this year as in 2011, when it invested about $90 million, while growing yuan-based deals are adding to the company's portfolio, Arvind Sodhani, president of Intel Capital and executive vice-president of Intel Corp, said on Wednesday.

Intel Capital invested $526 million last year in 158 transactions worldwide, half of which were outside the United States, and 89 of which were new deals.

China was the second-largest investment destination for Intel Capital last year following the US, with 12 percent of its global investment going to the Asian nation.

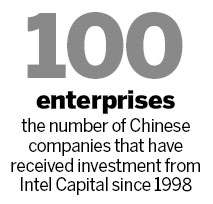

The US-based company, which entered China in 1998, has established two Intel Capital China Technology Funds with total capital of $700 million.

It has invested in more than 100 Chinese enterprises, including Sohu.com Inc, Phoenix New Media Ltd's ifeng.com, and China Cast Education Corp.

Sodhani said Intel Capital's total investment in China has surpassed $650 million.

According to Beijing-based investment consultancy Zero2IPO Group, venture capital firms invested $3.3 billion in China's Internet industry last year, a year-on-year increase of 260 percent, in 276 startups.

Ni Zhendong, the company's chairman, said because now is the down season for investing in Internet startups, yuan investment will have a good opportunity in the capital market.

Local yuan-based funds should be more involved in Internet investment, added Ni.

The international capital environment is suitable for China to set up more yuan-based funds, said Richard Hsu, managing director of Intel Capital China.

"Since 2007, we have more yuan-based deals, and the percentage is increasing," said Christine Wu, investment director of Intel Capital China.

Sodhani said the company's investment would focus on e-commerce, hand-held devices, cloud computing and data centers, and especially on building the mobile Internet ecosystem.

China's mobile Internet market received $207 million in investment in 2010, according to data from the Beijing-based research company Analysys International.

tuoyannan@chinadaily.com.cn