Value paradigm shifts as investors seek new philosophy in stocks

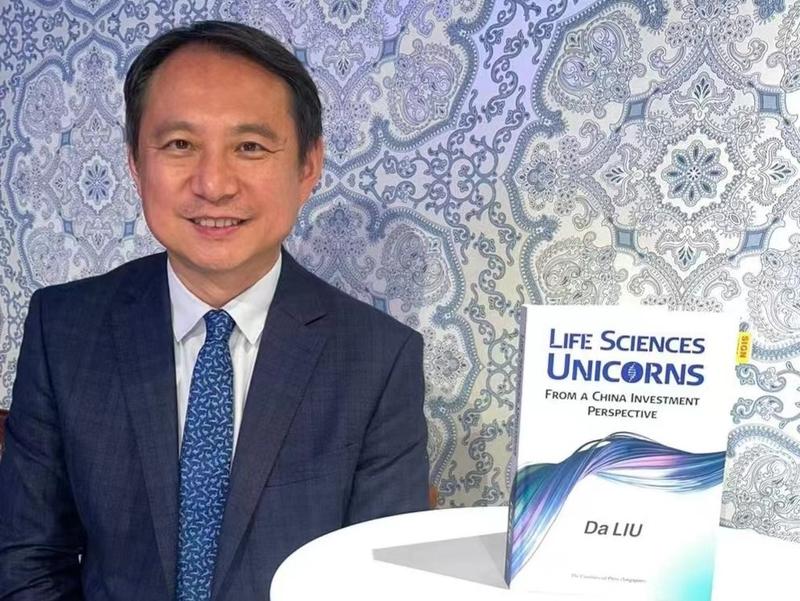

Liu, a graduate of St John's University's College of Pharmacy and Health Sciences in New York, and an MBA graduate of the Thunderbird School of Global Management, has poured his industry know-how into his recently published book, Life Sciences Unicorns: From a China Investment Perspective. He expects his efforts to nurture a fresh investment focus that will benefit the life sciences industry with promising products developed with innovative technologies.

Liu isn't the only investor riding the surging wave of the post-pandemic life and health business. In the past decade, the Nasdaq Biotechnology Index and the S&P Biotechnology Select Industry Index have skyrocketed 87.5 percent and 127 percent respectively. In the United States, about half a dozen biotech companies have gone public in the first two months of this year — a significant upturn following a long listing freeze.

However, Liu and many veteran Hong Kong investors are aware of the strong headwinds in store for the HKEX in an uphill battle. The underperformance of the SAR's stock market has more to do with capital flows than the actual environment. The total value of local initial public offerings has plunged by nearly 54 percent to a 20-year low of $5.9 billion among 68 listings, according to the latest Refinitiv data.

As the investment climate remains weak, political concerns have grown intense. Liu warns that geopolitics will remain as the chief stumbling block to cross-border investment. While the notion of "ABC" (anything but China) has taken hold among Western investors, anti-China US politicians promote "financial decoupling" to hurt the markets in the mainland and Hong Kong, he says.

He advocates a "paradigm shift" to deal with the crisis, saying that high-tech development will generate values that would translate into economic growth, boosting market liquidity in the long run.

- Shanghai records double-digit consumption growth during the Chinese New Year

- China Railway Guangzhou Group transports over 50m passengers since the start of travel rush

- Holiday records a new high in tourist trips and tourism-related spending

- Tap to hear Spring Festival traditions in Shandong

- White and pink flowers in full bloom in Guangzhou

- Egyptian-Chinese team unearths King Apries temple structure in Giza