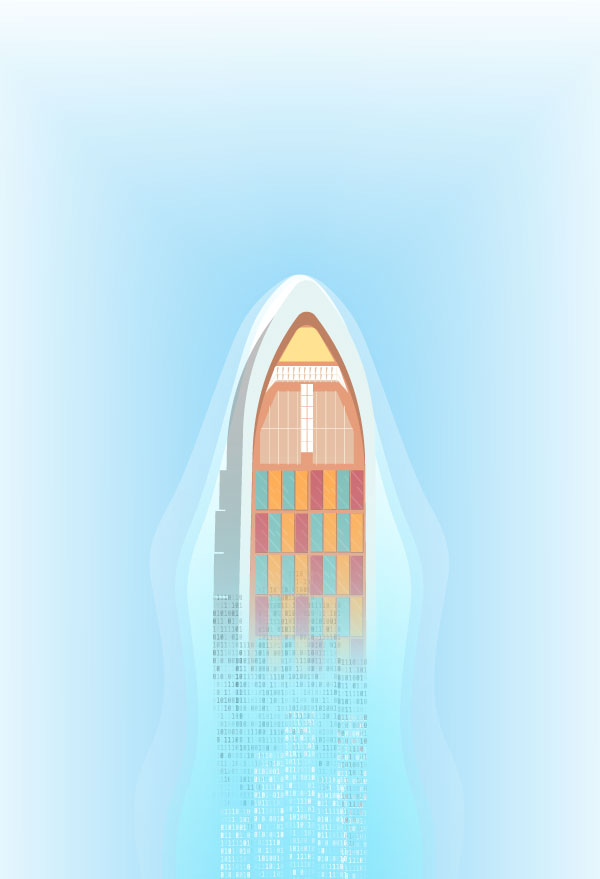

A smarter port to stay in the game

Maritime industry pundits are united in urging the HKSAR authorities, as well as stakeholders, to pull their socks up and embrace digitalization if the city is to remain a top-notch global maritime center. Li Xiaoyun reports from Hong Kong.

Hong Kong needs a highly digitalized network to drive its maritime business and take on "smarter" ports on the Chinese mainland and in the region. The special administrative region already boasts a prime location in the heart of Asia, robust financial strength, and sound infrastructure to take it forward, but industry veterans are adamant that digitalization, data sharing and government support are indispensable for boosting the SAR's status as a top-notch global maritime hub.

Hong Kong's maritime sector has had a rich history spanning more than 150 years and continues to be a vital pillar of the economy. According to the Hong Kong Maritime and Port Board, Hong Kong Port handled nearly 17 million twenty-foot equivalent unit containers last year, providing more than 240 international container liner services, covering over 460 destinations, each week.

The SAR's maritime services sector has been flourishing, with some 900 shipping companies offering a diverse range of services, such as maritime legal assistance, ship broking and maritime insurance work for international clients. As of late last year, the total tonnage of vessels registered in Hong Kong reached almost 128 million, cementing the city's position as the world's fourth-largest ship registry.

In his maiden Policy Address, Chief Executive John Lee Ka-chiu called for the active promotion of smart port development in Hong Kong, and stronger connectivity and data sharing among operators and stakeholders by setting up a port community system.

The Transport and Logistics Bureau has identified "promoting the development of smart initiatives and digitalization in the maritime industry" as one of the key priorities for the new Task Force on Maritime and Port Development Strategy.

However, the "going smart" drive hasn't been smooth sailing for the maritime and port business, which handles up to 90 percent of Hong Kong's external trade. One of the major impediments is a lack of space within the terminals for such transformation.

Hong Kong initially emerged as an export port, facilitating the shipment of goods from the mainland to destinations worldwide. Throughout these years, the evolving landscape saw the transformation of Hong Kong port's role from an export hub to a transshipment point, with the development of ports in Shenzhen. The growing cargo capacity of vessels, and the transshipment nature of cargo, which involves a significant portion of port space being used for cargo storage, have compounded the spatial challenges Hong Kong Port faces. According to Legislative Council member Frankie Yick Chi-ming, despite the implementation of automated solutions such as remote-control operations, remote container inspection, and digitalization of gatehouse workflows for import and export containers, as well as the launch of a 5G network paving the way for the trial of unmanned container trucks by the end of 2023, full automation has not yet been achieved.

He laments that about 20 percent of the 100-hectare back-up land at the Kwai Chung container terminals is used for commercial vehicle parking despite the acute shortage of land. "As early as 2013, I had proposed building a multi-storey parking facility to free up more land for port development", he recalls. His plan got the green light before the COVID-19 pandemic struck, and is now in the bidding phase.

Govt-led efforts matter

Yick says the SAR government needs to streamline approval process and release more land for further port development as soon as it can.

From the perspective of controlling costs and minimizing disruption to Hong Kong port's operations, Stanley Ng Chau-pei, president of the Hong Kong Federation of Trade Unions, said he believes the most feasible solution might be setting up a smart port by exploring new space on Lantau Island or New Territories West.

Ng, who's also a lawmaker, says it was awe-inspiring seeing the level of automation at Xiamen Port when he visited the Big Data Service Center and Xiamen International Shipping Science Innovation Center in the Xiamen Area of China (Fujian) Pilot Free Trade Zone recently. Even during the pandemic, Xiamen did not stop its port development, he says. "While Hong Kong Port used to be the most advanced and efficient in the region, my trip to Xiamen has made me realize it's time for our maritime industry to step up efforts to transform and upgrade."

He cites the SAR government having shelved a plan to build Container Terminal 10 on Tsing Yi Island after an almost five-year feasibility study. "This is a lesson and reflects a mindset that can lead to a vicious cycle - the more hesitant and cautious the government is about taking bold steps, the faster the industry will decline. If resolute action is taken, the sector can achieve rapid development."

Yick and Ng agree that the SAR government had been keeping a "hands-off" approach to developing the maritime and port business. But, the industry's notable advancement on the Chinese mainland and in Singapore reflects the integral role governments can play in propelling the industry's digitalization.

Ng says it's only through government-led efforts, coupled with industry collaboration, that the vision of a smart port and digitalization can be realized.

Edward Liu, principal representative of the International Chamber of Shipping (China) Liaison Office, agrees that collaboration among stakeholders for the maritime sector's digital transformation, including government agencies, shipping companies, port operators and technology providers, is paramount.

Hong Kong's nine container terminals are located in the Kwai Chung-Tsing Yi basin, managed and operated by five operators. Yick says the absence of a neutral party to facilitate data sharing among the operators has hindered the development of a smart port platform and the industry's digitalization as they're reluctant to share their commercially sensitive data.

Thus, the maritime and port industry has consistently urged the government to be a neutral coordinator in the past two decades, he recalls. The government has adopted a phased approach to establishing a brand-new data platform for facilitating data sharing in the maritime and port industry, thereby enhancing port efficiency.

Throughout the process, the government can set regulations and a framework to facilitate data sharing, while maintaining data privacy and security, says Liu. Industrial stakeholders can also collaborate in developing standardized protocols and platforms for data exchange.

While the industry has been shedding its reticence toward embracing new technologies, realizing that those who fail to adapt to changes will be phased out, high costs remain a challenge in adopting them. "Implementing digital transformation initiatives can involve significant upfront costs," Liu points out.

Lothair Lam Ming-fung, director and deputy general manager of Hong Kong Ming Wah Shipping Co, notes that increasing early-stage investment is inevitable for digital development. But, such investment is vital as building a digital platform and enhancing the company's big data analytics capabilities can help save labor costs and avoid losses due to erroneous decisions.

With a well-established digital management department, China Merchants Energy Shipping Co - the parent company of Hong Kong Ming Wah Shipping - leverages intelligent algorithms to manage maritime big data, including supply and demand of goods, as well as industry dynamics.

By integrating digital vessel operation and management platforms, onshore and onboard personnel can monitor operations of vessels simultaneously, helping them to select the most optimal routes, thereby enhancing operational efficiency.

Big data platforms can also facilitate collaboration among shipping entities and industry research institutions to make market forecasts and gain insights into market trends, enabling them to identify specific market segments that require increased capacity.

"Destinations and selection of routes for more than 100 vessels at Ming Wah are now based on the platforms' data-driven analysis, rather than relying on human judgment," says Lam. This indicates the effective utilization of big data platforms in achieving precision marketing, scientific scheduling, and optimizing allocation of resources.

In driving the development of high-end maritime services, the SAR government has implemented various tax incentives since 2020, including a tax exemption for ship leasing businesses, as well as half-rate tax concessions for marine insurance and shipping commercial principals, comprising ship managers, ship agents and ship brokers, with the aim of attracting more maritime businesses to Hong Kong.

Liu suggests that industrial stakeholders should conduct thorough cost-benefit analyses and demonstrate the long-term benefits and return on investment to lure investment and secure funding for digital transformation projects.

Filling the manpower gap

With the maritime industry hard hit by COVID-19, it's facing a severe shortage of manpower. The SAR government has expanded the talent list from 13 professions with recruitment difficulties to 51 in an effort to attract more talents to work in the SAR through various talent programs. The updated list includes professions in maritime services.

Secretary for Transport and Logistics Lam Sai-hung has said that to address the labor shortage and aging workforce in the shipping industry, the government is taking a multipronged approach, which includes implementing summer internship programs and offering job allowances or incentives to entice young people to join the industry.

"The government will continue to explore further measures under the Maritime and Aviation Training Fund to lure more talents. It'll also consider new initiatives to invigorate the industry and reinforce Hong Kong's status as a global maritime hub," said Lam.

The government-backed Maritime and Aviation Training Fund has been operating since April 2014, tasked with creating a vibrant, diverse and competitive pool of professionals and technical talents to support the long-term development of Hong Kong's maritime and aviation industries. The 2023-24 Budget had injected an additional HK$200 million ($25.54 million) into the fund.

Recounting his 25 years' seafaring experience, Lothair Lam says he obtained a captain's certificate in 2007. "The advent of digitalization and automation has alleviated the physical burden on modern-day crew members, but prompted a concomitant elevation of expectations of seafarers' knowledge, necessitating a grasp of both the theoretical understanding and practical experience in operating electronic instruments," he says.

Lucrative pay is among the key incentives offered to get young people to join the shipping industry, he says. The minimum monthly wage for a captain is around $10,000, and new crew members can earn about $3,000 a month.

Contact the writer at irisli@chinadailyhk.com

- Vice-president of Agricultural Development Bank of China under investigation

- PLA conducts routine patrols in South China Sea

- PLA conducts routine patrols in South China Sea: spokesman

- Annual session of Shanghai Municipal People's Congress concludes

- Global flavors meet festive cheer at Spring Festival fair in Shanghai

- Explore ancient and iconic architecture with Beautiful Hebei