Accounting services vital to mainland companies

Accountancy services, especially advice about complying with international financial reporting standards, and managing various operational risks, are highly sought after in the Hong Kong Special Administrative Region by Chinese mainland companies eyeing offshore markets.

Most Chinese enterprises in the Guangdong-Hong Kong-Macao Greater Bay Area that are exploring overseas expansion also require other professional services, such as sales and marketing.

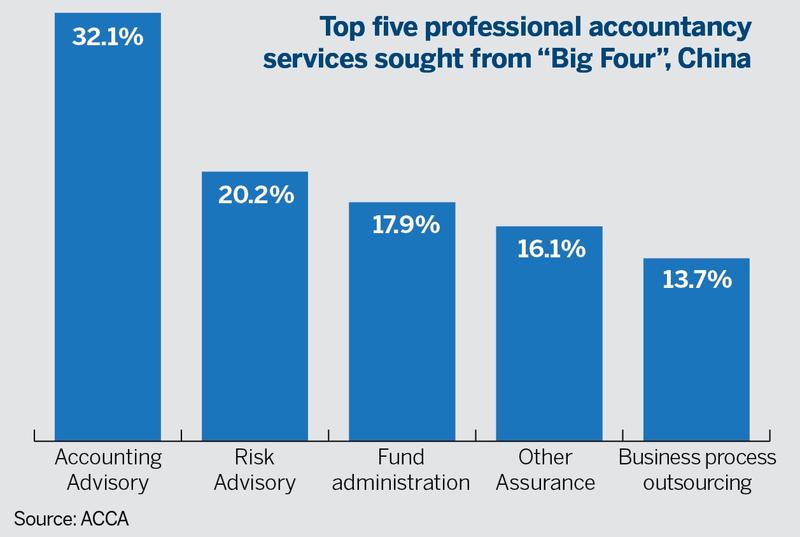

Ada Leung Suk-ping, director of the Association of Chartered Certified Accountants China, said the top five services sought by the "Big Four" accountancy firms are accounting advisory, risk advisory, fund administration, other assurance and business process outsourcing. These were identified from research.

"The high demand for accounting advisory, followed by risk advisory, is due to China's ongoing growth trajectory as an emerging market, where business ventures can be considered 'high risk', as described at a roundtable themed 'Market demand for professional accountancy services in the Asia-Pacific 2021-2024,''' Leung said.

"Multiple tax reforms, with significant changes to China's 'golden tax system', which facilitates greater automation of the tax preparation processes of enterprises, are driving demand for accountancy services.

"Fund administration and corporate support services, in general, are expected to increase as the Chinese economy becomes more asset management-based and as China switches from a manufacturing-based economy to a more sustainable, services-based model.''

Among the various accounting services, audit and assurance have been found to be the most important to Chinese mainland enterprises, based on ACCA research, said Leung.

"Accounting standards have become more complex. International Financial Reporting Standards 17 Insurance Contracts, for instance, is just one of the new accounting standards insurers must meet. It was described by one roundtable participant as the most complex IFRS. Finance professionals must stay up to date on the latest IFRS, which are constantly revised, a roundtable participant told the study. Familiarity with IFRS is also needed if Chinese companies intend to expand overseas.''

According to a survey by the Hong Kong Trade Development Council on Chinese mainland enterprises in the Greater Bay Area, almost all those interested in "going out" said they needed various professional services, Leung said.

"Among them, 49 percent were interested in joining marketing activities tailored for overseas and Belt and Road Initiative markets, while 47 percent wanted marketing strategies. Other professional services they need include product development and design (31 percent), banking, financing and project valuation (30 percent), brand design and marketing strategies (30 percent) and related legal and accounting services (30 percent).''

- National observatory urges preparedness measures amid north China cold spell

- Chongqing celebrates wintersweet bloom with floriculture festival

- Cornell students explore China's agricultural development

- China makes strides in promoting child development and fertility-friendly society: association

- Community memory clinics help aging minds stay connected

- Guangzhou's bald cypress trees turn red after cold snap