Hold on or quit? Coworking players call the shots

Crisis to opportunity

However, not everyone is beating a retreat. Lucy Lau, managing director of Hong Kong, Macao, Taiwan at coworking operator the Executive Centre, deems it a golden opportunity for relocations or expansions at more-affordable rents in core areas of Asia's financial hub.

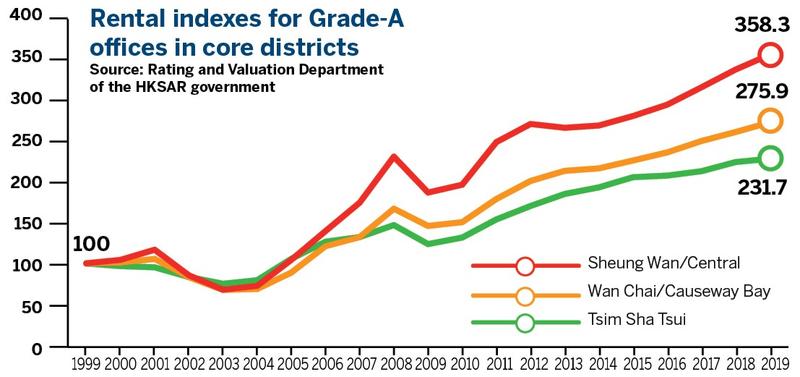

"We have been deterred by skyrocketing rents in Central for years." Lau said. Because of the bleak economic outlook and the spread of novel coronavirus, the Executive Centre recently managed to occupy a space in a Grade-A office building in the prime district as landlords offered discounts, she added.

The Executive Centre and its kind are not alone. "Today, there's no shortage of multinationals looking to play a waiting game and go bargain hunting in the city's office market. Many of them have long been stranded at the doorstep of the Hong Kong market by the notoriously hefty rents," said Lawrence Wan, Hong Kong-based senior director for advisory and transaction services in retail for CBRE, the world's largest commercial real estate services and investment firm.

Amid talks of crisis and hope, the top concern now for most coworking firms the world over is to survive and stay alive. Basically, the entire coworking business involves taking coworking spaces on lease from landlords and then subletting them to clients.

While operators are rushing to offer tenants rent holidays amid growing requests for rental waivers and cancellation of lease agreements, operators' pleas for rent concessions from landlords have largely fallen on deaf ears.

Occupancy rates and new-inquiry levels go all the way down across the once-booming sector. Many market players are simply on the verge of collapse, with incomes plunging, but major expenses fixed.

Operators like New York-based WeWork have temporarily closed some of its offices worldwide for cleanups after coronavirus exposures. As working from home and social distancing have, at least for the time being, become standard corporate policy for most countries, other coworking space firms, including WeWork's smaller rival, Knotel, have suspended operations or reduced their office space and staff count until the public health crisis is over.

The virus has not only driven away coworking space companies' customers, but also fundamentally challenged the future viability of their shoulder-to-shoulder business model.

The emergence of coronavirus diagnoses — from WeWork's largest location in London's Waterloo neighborhood to Los Angles, Seattle and Manhattan — poses an even bigger problem: Will proximity to other people be considered risky in the future?

With extra cleaning and hygiene provision in place, WeWork aims to convince tenants that the "we work together" model still works after the pandemic. The company, which is struggling to pay its April rents to some landlords, has drawn up a post-pandemic plan that emphasizes open space and more distance to make it easier for tenants to move around without being too close to each other.

But more space apparently means fewer tenants per location. This could weigh down on its already-declining rental income.

Today, just as coworking space firms are desperately looking for ways to shed underperforming offices by cutting deals with their landlords, many apprehensive tenants intend to move out of the coworking space buildings for good, and probably will not return on gloomy economic prospects and tight budgets.

Despite an industry shakeout, some of its lure may still be retained and cherished.

"Coworking is all about members sharing working space and a set of values. It offers a solution for like-minded peers to become part of a close-knit community," said Myles Huang, research director of capital markets at JLL Asia Pacific. "This cannot be found at home or in traditional offices."

- Chinese researchers create novel computing architecture for major power boost

- Chinese astronauts conduct key training, experiments on space station

- China maintains strong momentum in anti-corruption drive

- China maps cotton's evolutionary secrets to build better crops

- Chinese president appoints new ambassadors

- Chinese researchers develop 'smart eyes' for grazing robots