Leadership pledges to control financial risks

Coordinated regulation

The government's reform of the financial regulatory system, aimed at improving coordination of different government agencies, will also be crucial to the prevention of financial risks.

In the Government Work Report, Li said the country will strengthen coordination of financial regulation and will also improve regulation of shadow banking, internet finance and financial holding companies.

The reform of the country's financial regulatory system is part of a plan devised by the State Council, China's Cabinet, to use structural reform to streamline and optimize State institutions.

The strategy was unveiled last month at the Third Plenary Session of the 19th Communist Party of China Central Committee.

"Strengthened coordination among regulators will help to eradicate the regulatory void and regulatory arbitrage, enabling full regulatory penetration and coverage. This will help to facilitate the smooth process of financial deleveraging," said Cheng Shi, chief economist at ICBC International.

"The improved regulations will also help to eliminate illegal borrowing by local governments and resolve the issue of their hidden debts."

China has already established the Financial Stability and Development Committee, which will serve as an interagency regulatory coordinator to ensure financial stability and fend off risks. The future role and policies of the committee are expected to be discussed and clarified during the two sessions.

Zhou said the PBOC will play a bigger role in the country's financial regulatory framework because the office of the newly established interagency committee is located within the central bank.

Iris Pang, a China economist at ING Bank, said the "financial super-regulator" will steer the reforms to guard against risks emanating from areas such as online financing platforms, personal loans and wealth management products.

"Financial deleveraging will be the key reform of 2018 because the government is determined to clean up shadow banking in the financial sector," she said.

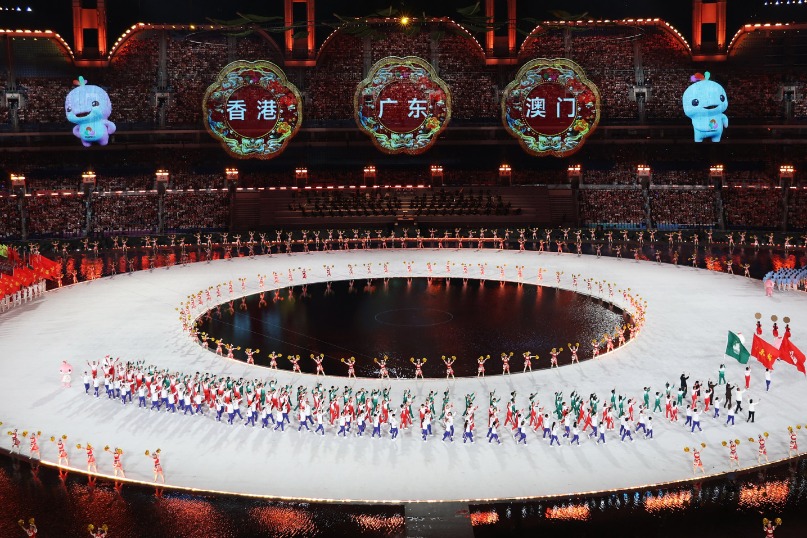

- National Games showcase Guangdong, Hong Kong, Macao cuisine

- Xiangyang legislators expand public feedback channels

- Beijing court cracks down on medical fraud cases

- Gambling ringleader sent back to China

- Intl experts raise alarm over the accelerating loss of biodiversity

- China's power battery industry records nearly 50% jump in sales