Most economists call rebalancing essential

| A customer in front of wine shelf at a supermarket in Xuchang, Henan province. Geng Guoqing / for China Daily |

Services overtake manufacturing as biggest contributor to growth

Is the economy at last turning? The Chinese government's policies to rebalance the economy seem to be bearing some fruit at last.

The latest economic data published by the National Bureau of Statistics on July 16 suggest China is moving to a more service-based economy that is less reliant on exporting cheap manufactured goods.

On the expenditure side of national income, consumption also continued to play a stronger role, contributing the largest share of GDP growth.

Achieving such shifts was the central aim of both the current 12th Five-Year Plan (2011-15) and last year's Third Plenum meeting - setting the economic course for the next 10 years.

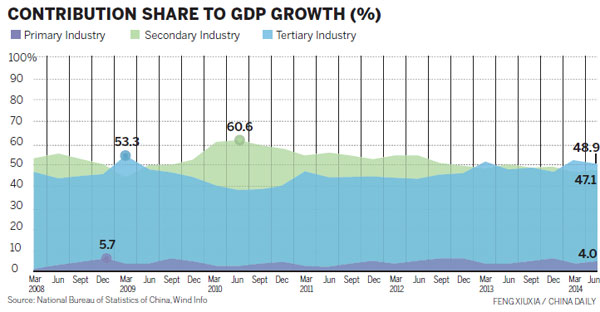

In the second quarter of this year, services accounted for 48.9 percent of GDP growth, compared with 47.1 percent for the secondary sector, mainly comprised of manufacturing.

This represented a complete turnaround from the second quarter of 2012, when services accounted for just 42.7 percent of growth with the lion's share (53 percent) fueled by the secondary sector.

Consumption also accounted for more than half of GDP growth for the second quarter in a row. It made up 54.4 percent, compared with 48.5 percent for investment, while net exports made a negative 2.9 percent contribution. Although the figure for consumption was down from the 64.9 percent in the first quarter, it could still provide evidence of a continued rebalancing.

The picture certainly appears better than last year when investment actually increased as a share of GDP from 45.7 percent in 2012 to 45.9 percent, mainly as a result of the mid-year mini stimulus for targeted infrastructure projects. Consumption also increased only marginally last year from 49.5 to 49.8 percent.

Central to the government's rebalancing strategy are initiatives such as the Shanghai Free Trade Zone, launched last year and at the vanguard of China's financial reforms.

Other moves involve setting up a better social security and healthcare system so people become less reliant on having to save and can therefore consume more.

A major reform also involves the hukou, or household registration system, giving greater rights to migrant workers and their families to settle in cities and become consuming citizens.

Underpinning the reforms also is a change in mindset, with the government already demonstrating that it is less inclined to embark on major infrastructure projects just to maintain GDP growth at artificially high levels.

It did, however, announce in April a minor stimulus aimed at more social housing construction and accelerating railway development.

George Magnus, senior independent economic adviser for UBS in London, says the recent data clearly shows a trend.

"I think there is little question that rebalancing is happening. It was always going to happen in my view. The only questions were how and how quickly," he says.

The economist, who was author of Uprising: Will Emerging Markets Shape or Shake the World Economy, which warned of the risks of an investment bust in China if rebalancing did not take place, points out that one of the indicators of rebalancing is a decline in property investment.

Real estate investment was 4.2 trillion yuan ($677 billion) in the first six months, a 14.1 percent increase over the same period last year but down from increases of more than 19 percent that predominated throughout 2013.

"We can see the start of a protracted downswing in property and construction investment. This is of huge consequence as this sector has been the leading edge of China's expansion for over 10 years," he says.

Duncan Innes-Ker, regional editor for Asia at the Economist Intelligence Unit in London, says one explanation for the strong first half data suggesting rebalancing is the increased role consumption tends to play in the early part of the year.

"The first thing to remember is that consumption tends to be much stronger in the first quarter of the year in China, owing to the timing of the Chinese New Year, which means that you quite often see its contribution to GDP growth starting off strong and then easing through the rest of the year."

Innes-Ker, who was previously a senior China economist of the EIU in Beijing, senses, however, that this time there may be a more fundamental change taking place.

"There are good reasons to expect that consumption will play a more important role this year. The weakening of property investment is unlikely to be reversed anytime soon, and will play a big role in dampening investment's contribution to growth.

"The underlying outlook for consumer demand also remains very positive, with incomes rising at double-digit rates and fields such as e-commerce expanding at a phenomenal pace."

Mark Williams, chief Asia economist at Capital Economics, also in London, says interpreting the China rebalancing story often depends on whether you are an optimist or pessimist.

"The glass-half-full view is that the imbalance has stopped getting worse. The half-empty view is that the difficult transition of weaning the economy off investment has not yet begun."

He does, however, believe there are some positive trends that suggest rebalancing is actually taking place.

"There has been a big slowdown in real estate construction. It might be giving people the jitters now but it is needed for the overheated construction sector to return to a sustainable path. Meanwhile, other parts of the service sector have continued to do well."

He, too, believes it is difficult to make firm judgments based on the last two quarters' data.

"If we look over the past four quarters, consumption and investment have contributed roughly the same to growth and this suggests both have now stabilized relative to GDP."

Jonathan Garner, chief Asia strategist of Morgan Stanley, based in Hong Kong, is confident China is achieving rebalancing and is now at the point Japan reached in the 1970s and South Korea in the 1980s.

"If you look at the economic history of both South Korea and Japan, China is about to reach the GDP per capita that they both reached when a consumer society took hold.

"At that point, most of the physical infrastructure has been done and the savings ratio begins to fall."

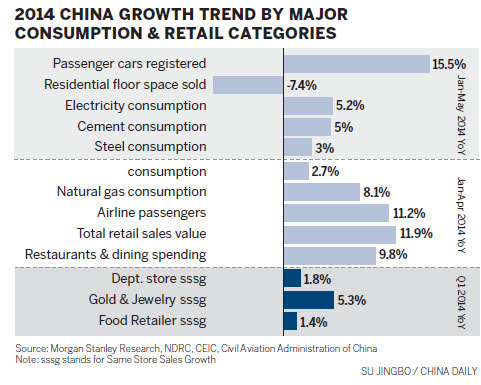

Garner, who presented his own research on China's rebalancing and reform agenda in Beijing last month, says much of the evidence of rebalancing is seen in consumption data. The number of passenger cars registered in the first five months of 2014, according to Morgan Stanley research, increased 15.5 percent over the same period last year, faster than items associated with investment spending, like cement consumption increasing 5 percent and that of steel just 3 percent.

"These are drawn from the official China statistics and it is a trend that has been running for three to four years and still has further to run," he says.

Louis Kuijs, chief China economist at the Royal Bank of Scotland, also says it is difficult to make solid assessments on the 2014 data to date.

"I think data relating to consumption, investment and exports can be pretty decent at an annual level but more problematic in making firm conclusions about it at a quarterly level," he says.

He is prepared to give the government some credit with its policy responses and actions.

"I think government policies like exchange rate appreciation have shifted the terms of trade in favor of the non-tradable sector, which tends to favor the domestically oriented services sector," he says.

This was one of the factors that led services to increase as a proportion of GDP from 44.6 percent in 2012 to 46.1 percent last year, while the secondary sector declined over the same period from 45.3 to 43.9 percent.

"Some of the change can simply be explained by relative price changes, however. There has been downward pressure on factory gate prices over this period, which affects manufacturing but not services. So what you might be seeing also in the statistics is the price impact on the data and not volume effects."

Yifan Hu, managing director, chief economist and head of research at Haitong International, the Shanghai-based securities firm, says rebalancing the economy is a long haul.

At the start of the decade, the government set itself the goal of doubling China's per capita income by 2020.

"This is very much a long-term program. Maybe in the short term, even judging by the recent data, we haven't made a lot of progress yet, but I think the government is making a significant effort."

Hu says the government needs to make reallocating wealth a priority so there is not such a concentration of wealth among a few individuals.

"For this to work, there has to be a lot more social transfers so that there is better wealth allocation so as to boost consumption."

She also argues that the adjustment the Chinese economy needs to make in services is not necessarily into high-end sectors.

"There should be much more focus on lower-end services. After 10 pm in many parts of China you can't find many restaurants open," she says.

"From my point of view, services provision is like a pyramid. You should focus on areas like catering at the bottom and then build up to the provision of middle-level services like in education, and then high end such as private hospitals and financial services."

Zhu Tian, professor of economics at China Europe International Business School, believes official statistics actually under-report the existing strength of China's services sector.

"If you take a company like (China computer manufacturer) Lenovo, for example. It is supposed to be a manufacturing company. However, it also provides a lot of services. All this is counted as manufacturing, not services," he says.

Zhu is also skeptical about reading too much into the latest official data.

"If you look at small data changes, it doesn't mean very much because the economy fluctuates and consumption and investment as a proportion of GDP can jump very rapidly."

Zhu, however, believes that consumption in the economy is also significantly underestimated in the official statistics but even as it is currently reported, he would not see any need for major rebalancing.

"My central argument is there is no need for rebalancing anyway. If consumption is low and investment is high, what is wrong with that, because consumption actually doesn't make the economy grow? It is investment that does that."

Oliver Barron, head of the Beijing office, North Square Blue Oak, the global institutional broker and research company, thinks it is futile to become involved in debates about the official data. "There are reasonable discussions to have about the data but the point is that the government is judged on the official statistics and not by other versions of them."

Barron believes the rise in consumption picked up in the first half of this year has more to do with the slowing growth of exports and a weak property sector affecting investment.

"The other two components (investment and better exports) were much smaller, so by comparison consumption is much bigger."

He does, however, think the government is on the right course with some of its policies, particularly the People's Bank of China, China's central bank, cutting the reserve requirement ratio earlier this month so some banks can extend consumer finance.

"I think this is the way to get consumer spending going. The United States became a consumer society through consumer finance and spending on credit cards, and I think China will do it the same way.

"It looks as though the central bank is trying to shift the banking culture away from just lending to state-owned enterprises and getting them to lend not just to small businesses but also to consumers."

Magnus at UBS, however, thinks the apparent rebalancing is less about government policies designed to boost household consumption and more about an investment slowdown.

"I think if you define rebalancing as a radical shift in government policy to downplay investment and boost household consumption, I don't believe there has been much progress on that so far."

He says the government's investment stimulus in April means it has not yet weaned itself off measures designed to maintain growth at the target rate.

"Essentially the government is pursuing stimulus by stealth, avoiding the large-scale, headline-grabbing stimulus of the past but nonetheless trying to sustain the existing development model with housing investments and various infrastructure programs," he says.

Innes-Ker at the EIU says while there is real evidence of rebalancing on the production side of the economy, with the service sector in China beginning to gain real momentum, the picture is much less clear cut with consumption.

"I think we can be fairly confident that the trend for the service sector to be the larger part of the economy is going to continue but when it comes to consumption, we still need to see what happens in the second half," he says.

"My own feeling is that the government is more comfortable to allowing a steeper slowdown in investment this year than last."

andrewmoody@chinadaily.com.cn

(China Daily Africa Weekly 07/25/2014 page14)

Today's Top News

- China reports 5% GDP growth in 2025

- Sanya rises as magnet for Russian tourists

- China's steady opening-up for Asia-Pacific economic growth

- Blueprint seen as a boon for entire world

- 'Kill line' an inevitable outcome of US system

- Fusion energy drive entering a decisive phase