IMF calls on G20 to boost growth

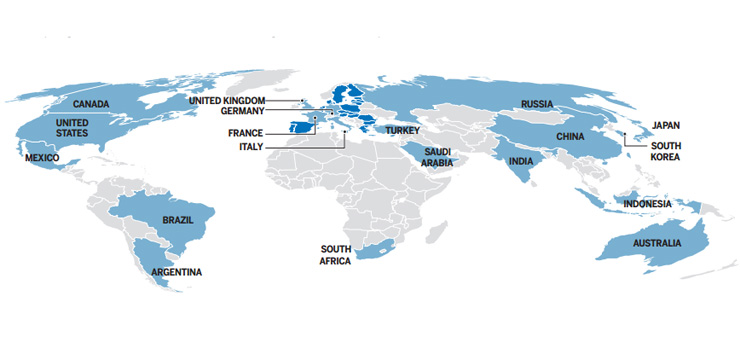

WASHINGTON - An uneven and brittle global recovery highlighted the importance of the Group of 20 (G20) commitments to raise global growth, the International Monetary Fund (IMF) said in a report on Wednesday.

Key developments since the October World Economic Outlook (WEO) report include a financial market correction, appreciably lower oil prices, and some further signs of weakness in activity.

Sovereign bond yields in advanced economies, which had fallen since the spring, declined further in October. Equity prices, which trended up till late-September, have declined since, notably in emerging economies, where risk spreads have increased.

The recent increase in financial market volatility is a reminder of potential risks and potential further corrections, the IMF said. Recent data releases also point to weak domestic demand in the euro area.

Downside risks identified in the October WEO remain significant, the report noted. Heightened geopolitical tensions and potential corrections in financial markets are the main short-term risks. Other risks are low inflation and deflation in the euro area and low potential growth.

To cope with the realities, advanced economies should keep accommodative monetary policies, given still large output gaps and very low inflation, the Fund said.

"While monetary policy normalization will be coming to the forefront in the United States and the United Kingdom, accommodative monetary policy in the euro area and Japan should continue to fight low inflation," it said.

To prevent premature monetary tightening, macro-prudential tools to mitigate financial stability risks - for example, in the housing market -should be the first line of defense, it said. Fiscal consolidation should continue to balance fiscal sustainability and growth within credible medium-term plans.

In emerging economies, the focus of macroeconomic policies should remain on rebuilding buffers and addressing vulnerabilities, in preparation for an environment characterized by tighter external financing conditions and higher volatility.

A higher priority should be placed on growth enhancing structural reforms across G20 economies. Some countries with protracted current account surpluses should focus on boosting domestic demand or modifying its composition, the IMF urged.

"Further labor and product market reforms are needed in much of the euro area. In a number of euro area countries severely affected by the crisis and emerging economies with protracted current account deficits, there is a need for reforms which increase competitiveness, together with wage moderation," said the report.

Related Stories

Australian informality to encourage friendly, open G20 discussion 2014-11-13 10:14

World leaders set to arrive for G20 2014-11-13 09:53

Brisbane tightens security for G20 2014-11-13 08:03

Chinese president to attend G20 Summit in Australia 2014-11-07 13:25

Brisbane Airport bans climate ad ahead of G20 2014-11-04 07:52

Background