Merkel risks rebellion on euro rescue fund

Updated: 2011-09-28 11:04

(Agencies)

|

|||||||||||

|

|

|

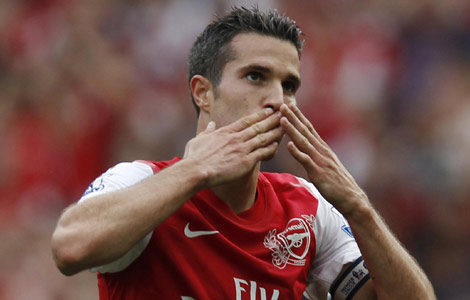

German Chancellor Angela Merkel (R) and Greek Prime Minister George Papandreou speak to reporters at the Chancellery in Berlin Sept 27, 2011. Papandreou, who must implement reforms to receive further aid, is meeting Merkel to discuss the euro zone debt crisis, two days before a parliamentary vote in Berlin on an expanded bailout fund to prop up weaker members in the bloc. [Photo/Agencies] |

Talk of proposals to leverage up the 440 billion euro ($598.5 billion) bailout fund to multiply Europe's financial firepower lifted global stocks on Tuesday but made it harder for Merkel to unite her fractious center-right coalition.

The Bundestag (lower house) is sure to approve a widening of the scope of the European Financial Stability Facility to aid weak states and banks, agreed by European leaders in July, since the opposition Social Democrats and Greens say they will vote for the measure on Thursday.

But a revolt by Euro skeptical backbenchers hostile to further bailouts in Merkel's conservatives and their liberal Free Democratic coalition partners may leave her without a majority in her own camp.

In an internal vote on Tuesday, 11 deputies from Merkel's CDU/CSU group voted against the motion and two abstained. Coalition sources said they expected between 2 and 5 FDP lawmakers to vote against and up to 6 to abstain.

If more than 19 coalition lawmakers vote against or abstain, Merkel will be dependent on opposition votes in a political humiliation that could weaken her ability to push through future rescues.

European shares surged by 4.3 percent in the biggest one-day percentage gain since May 2010 and safe-haven German bonds fell on reports that policymakers were preparing decisive action to tackle the debt crisis.

The cost of insuring Italian, Spanish and French debt against default also fell on hopes of a bold solution, which appear to have little grounding in immediate political reality.

German Finance Minister Wolfgang Schaeuble was forced to deny that any increase in the volume of the bailout fund is planned in a bid to calm irate center-right lawmakers.

"We do not intend to increase it," Schaeuble told n-tv.

That did not directly address the question of whether the EFSF fund could be leveraged to raise more money to prevent contagion spreading from Greece to Italy and Spain, the euro zone's third and fourth economies.

Hot Topics

Libya conflict, Gaddafi, Oil spill, Palace Museum scandal, Inflation, Japan's new PM, Trapped miners, Mooncake tax, Weekly photos, Hurricane Irene

Editor's Picks

|

|

|

|

|

|