Global Biz

Glittering times ahead for commodity firms

(China Daily)

Updated: 2010-01-01 09:52

|

Large Medium Small |

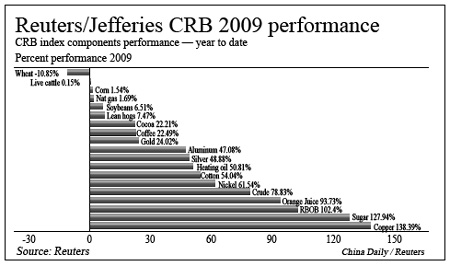

SINGAPORE: Commodity markets saw their strongest year in 2009 since 1973, lifted by oil's biggest gains in a decade and a 140 percent surge in copper prices.

The Reuters/Jefferies CRB index rose nearly 24 percent in 2009, while gold saw its ninth increase in as many years. Sugar soared to record highs and cocoa peaked in what traders described as "the year of commodities".

But the strategies that worked in 2009 may fail this year as the market switches from picking up bargains left in the wake of the financial market meltdown that started in 2008 to a strategy based on macro economic data and fundamentals.

| ||||

First amongst CRB constituents is copper, which rallied nearly 140 percent in 2009.

Unprecedented levels of Chinese imports, speculative fervor and more lately, threats to supply, have pushed London copper from a 50-month low of $2,825 in December 2008 to a 16-month peak of $7,415 on New Year's Eve.

Sugar is another standout in 2009 - up the best part of 130 percent. "2010 may be the year of the tiger, but 2009 was the year of commodities," a trader in Sydney said.

"I am a little surprised markets haven't given back more for the end of the year. Given that, I reckon 2010 will see us off to the races. Precious metals in particular should chase higher."

He said gold, currently at $1,197.7 and up a quarter last year and having touched a record high of $1,226.10 in early December, would find support down to $1,070, with investors targeting a move towards $1,300 or higher.

But he doubted sugar would repeat its sweet 2009 performance. "The thing with sugar is that it can fix itself in a year. It's not like the eight years it takes to build a copper mine or 25 years an oil refinery can take."

Oil prices have also surged, up nearly 80 percent in the year, but the market would need to rally an additional more than 80 percent to top its record high of 2008 near $150 a barrel.

On the downside, grains failed to inspire last year - wheat has tumbled 11 percent while corn managed a paltry 1.5 percent rise.

Soy rose 6.5 percent for the year, with strong demand led by top buyer China and poor supplies from Latin America countered by a record US harvest.

Reuters