Key trends in China's inflation

Updated: 2011-11-11 18:20

By John Ross (chinadaily.com.cn)

|

|||||||||||

Throughout 2011 China’s government has set as the top priority bringing inflation under control. Successes in this were widely recognized when October’s annual consumer price index (CPI) increase fell to 5.5 percent compared to July’s peak of 6.5 percent. For reasons examined below there are likely to be further success in bringing down inflation. But analyzing what is the primary factor causing CPI inflation in China is crucial both for predicting its path and for future economic policy.

Analysis of the economic data shows clearly that the decisive factor driving CPI rates in China were international. They did not lie in China’s domestic monetary conditions as a number of analysts have claimed. This does not mean that monetary growth in China was not important in other regards – for example it was a major factor in house price increases. But correctly analyzing what factors decisively determined changes in China’s CPI is both important in itself and because incorrect factual analysis is used to try to undermine recognition of the economic success of China’s 2008 stimulus package compared to the failed stimulus programs in the US and Europe.

The comparison of the economic growth produced by China’s stimulus package with results in other major centres is extremely striking. Ideally a comparison of economic growth would be made between the 4th quarter of 2007, the peak of the previous US business cycle, and the latest available data for the US and China, which is for the 3rd quarter of 2011. However, until the beginning of this year China did not produce quarter by quarter GDP growth figures but only comparisons with a year previously. To make an analysis up to the 3rd quarter of 2011 it is therefore necessary to use data which makes a four year comparison to the 3rd quarter of 2007. However the statistical difference is marginal – US GDP growth between the 3rd and 4th quarters of 2007 was only 0.4 percent.

Between the 3rd quarter of 2007 and the 3rd quarter of 2011 China’s economy grew by 42.2 percent. In comparison the US economy grew by only 0.6 percent. That is, China’s economic growth in that period was 70 times as fast as that in the US. From the 3rd quarter of 2007 until the 2nd quarter of 2011, the latest for which data is available, the European Union’s economy contracted by 0.9 percent and Japan’s shrank by 4.9 percent.

Compared to the failure of stimulus packages in the other major economic centres China’s 2008 stimulus package must be considered one of the most successful pieces of macroeconomic management in economic history.

Given this economic result even if the domestic monetary expansion in China required for the stimulus package had been responsible for CPI increases this would still have been a relatively modest price to pay compared to the success achieved. But the data shows clearly that the domestic monetary expansion was not primarily responsible for China’s CPI inflation, and that the latter was primarily linked to international commodity price trends.

A simple international analysis makes this clear even before considering the detailed correlations which are considered below. To make comparisons of inflation in China with other countries economies at comparable stages of economic development must be considered – a comparison of a developing country, China, with developed ones is not valid due to their different economic positions. A suitable comparison is therefore with the large developing economies of the BRIC (Brazil, Russia, India, China) countries.

Such comparison shows that China had the lowest inflation among BRIC economies. As not all these countries have yet published inflation figures for October a comparison of September’s data shows that inflation was 6.1 percent in China, 7.2 percent in Russia, 7.2 percent in Brazil and 10.1 percent in India. China and Russia have published October CPI data – 5.5 percent for China and 7.2 percent for Russia. As China’s money supply was clearly not a determining factor in inflation in Brazil, India or Russia the fact that all of these had a higher inflation rate than China shows that ‘excessive’ expansion of China’s money supply was not the primary cause of its upward CPI pressures. The upward inflationary trend was international in character.

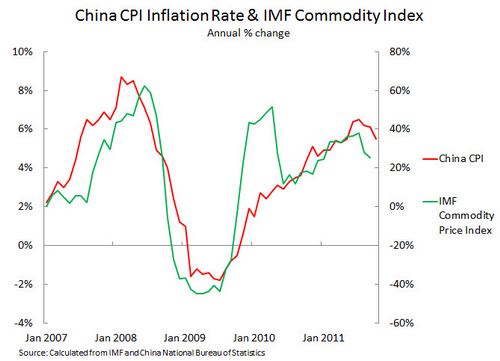

But the data shows clearly shows a close correlation between China’s CPI and world commodity prices. This is illustrated in Figure 1, which shows the annual changes in China’s CPI and in the IMF’s international commodity price index . The parallel upward and downward movement of world commodity prices and China’s CPI is evident.

The direction of causation between the two is clear. China’s CPI is simply not a sufficiently large factor in the world economy to determine world commodity prices. In terms of causality, therefore, either world commodity prices cause the changes in China’s CPI or a third factor, for example international supply and demand, causes parallel changes in both. In either case examining international commodity prices allows trends in China’s CPI to be analyzed.

This close correlation gives good news for future trends in China’s CPI. Year on year changes in international commodity prices are currently falling rapidly. The year on year increase in the daily Dow Jones-UBS international commodity index has dropped from a maximum of 52.8 percent in March to only 1.2 percent on 9th November. The annual increase in The Economist weekly index of commodity prices has dropped from a rise of 53.1 percent in February to a fall of 8.7 percent by 8th November. Given the close correlation between China’s CPI and international commodity prices these sharp falls in international commodity prices should create good conditions for China’s fight with inflation.

Naturally not all the news is good. The reason commodity prices are falling so fast is due to the international economic slowdown – which has negative consequences for China’s exports. But the fact that China’s CPI is closely correlated with international commodity prices, which are now dropping, will give increasing scope for China’s government to adopt a more expansionary stance on its domestic economy.

John Ross is Visiting Professor at Antai College of Economics and Management, Shanghai Jiao Tong University. From 2000 to 2008, he was then London Mayor Ken Livingstone's Policy Director of Economic and Business Policy. The views expressed here do not necessarily reflect those of the China Daily website.