Where does China stand today in building world class companies?

Updated: 2011-07-13 14:06

By John Ross (chinadaily.com.cn)

|

|||||||||||

Building world-class companies is central to China's economic future. To make a comparison, the great historical strength of the US economy was not only its size but the character of the companies on which it rested. For a century, Ford, General Motors, IBM, and others defined what a great international company was.

That list itself shows the decline from that peak that the US has suffered. General Motors today is associated more with bankruptcy than the fact that for many decades it was the world's leading company. After World War II, for the first time US firms were beaten in competition - particularly by Japanese firms in fields such as automobiles and consumer electronics. Toyota, Honda and Sony came to symbolize excellence in these industries. Today such Japanese companies are themselves under pressure from South Korea’s Samsung, LG and others. But US companies still dominate the world in many fields, and firms such as Apple, Walmart and Google lead new sectors.

What, therefore, is China's current position in the process of building world-leading companies? On such an important issue, it is vital not to rely purely on individual cases - this gives a distorted picture. Simply pointing to Haier (world number one in refrigerators and domestic goods), ICBC (world's largest bank by market capitalization), or Huawei (world's number two telecommunications equipment producer) gives an exaggerated impression of China's strength - in the majority of industries, China does not yet have equivalent companies. Conversely, statements by critics of China, such as British economist Will Hutton, that China does not yet have a series of world-leading brands, for example to rival Apple in consumer electronics, is equally unbalanced.

China is a developing country. Its GDP per capita is still only equivalent to Japan in 1966 or South Korea in 1986. China is today strong in precisely the same industries, for example steel or shipbuilding, in which Japan and South Korea excelled at their comparable economic stage. In 1966 or 1986, the "glory" period of Japanese or South Korean economic development, their creation of a whole range of world-leading consumer brands still lay ahead.

Despite the enormous achievements of China's economy, it can't perform magic and jump over decades of development. Judged by international standards, even with the greatest skill it will take many years for China to build a series of world-leading brands across a wide range of industries.

The goal is achievable. Companies that are currently world-leading, for example Toyota or Samsung, had huge failures in their first steps in going global. But as building such companies takes time, it is important to look systematically at the position of China's companies in international competition.

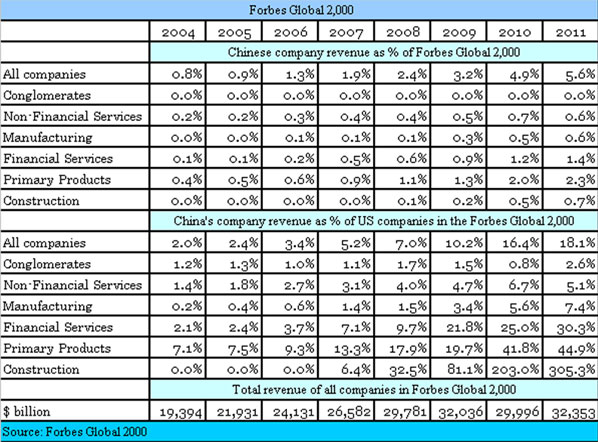

To aid in such a benchmark, Table 1 (below) shows the percentage position by revenue of China's companies among the world's 2,000 largest publicly listed companies - the Forbes Global 2,000. Data is shown by economic sector. The comprehensive character of the coverage is shown by the fact that the revenue of the companies analyzed is equivalent to 50 percent of world GDP. It is worth drawing out the main trends.

Rapid overall progress has been made by China's large companies. In 2004 their revenue was only 0.8 percent of the Forbes Global 2,000. Revenue of the US's large companies was 50 times that of China's. By 2011 the relative revenue of China's large companies had increased sevenfold, to 5.6 percent of the Forbes Global 2,000.

But although that is huge progress, it still shows the task ahead. In 2011 revenue of US large companies were still over five times as large as China’s. China’s large companies together in size were still just behind those of the individual European countries of France, Britain and the UK and less than half of Japan's.

But the point repeatedly emphasized by China's economic policy makers that it still lags greatly in areas of high value-added production is shown vividly in the manufacturing and non-financial services, where US companies still dwarf their Chinese competitors.

How quickly can China make up this gap in company development? Naturally it is not possible to predict exactly and it will differ by industry. But some comparisons can give ballpark estimates.

South Korea's Samsung took 10-15 years to go from 1986, when it was primarily a manufacturer for other companies' brands, to become a leading world brand itself. Japan’s car companies became a huge force in the international market approximately a decade after 1966. To take an economy's development as a whole, it took Singapore 37 year to go from China's current GDP per capita to become the first Asian economy to overtake the US by this measure.

The type of number that emerges from such comparisons is therefore about 10 years for China to begin to have a significant number of brands in consumer products, and 35 years to achieve the same level of development as the US.

Such historical comparisons based on company development, interestingly, give approximately the same results as macro-economic projections. The latter shows that China’s total GDP will overtake that of the US in less than 10 years, but even on optimistic assumptions it will take 25-30 years for China’s GDP per capita to equal the US.

China's companies have made enormous strides. Much remains to be done.

John Ross is Visiting Professor at Antai College of Economics and Management, Shanghai Jiao Tong University. From 2000 to 2008, he was then London mayor Ken Livingstone's Policy Director of Economic and Business Policy. The views expressed here do not necessarily reflect those of the China Daily website.