|

OPINION> OP-ED CONTRIBUTORS

|

|

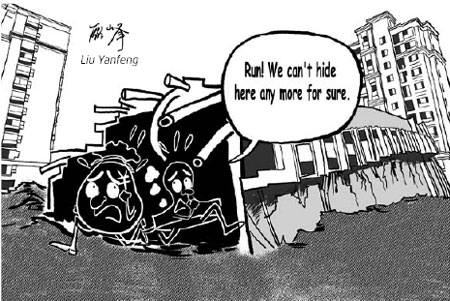

Realty's unscrupulous reality

By Huang Xiangyang (China Daily)

Updated: 2009-07-04 08:30

The collapse of a 13-storey building in Shanghai's Minhang district last week has sent shivers down the spines of homeowners as well as potential buyers, who have either spent or are ready to spend their life savings on a dream house. Worries of daily life have haunted us for long. Right from rocketing property costs to contaminated foodstuff to unforeseen tragedies - the latest being the Chengdu bus blaze that killed 27 people, and not to forget the Chenzhou train collision. If that wasn't already enough now we have to worry about our houses dropping to the ground. Imagine returning home after a hard day at work and not being able to relax for fear that your apartment bloc may collapse any moment. It was a massive tragedy averted purely by chance. Had the apartments in the under-construction residential complex been occupied, hundreds would have perished, families would have been destroyed, children would have been orphaned. The scary question now is, how many buildings are standing tall out there ready to turn into concrete graves anytime? The local legislature called the collapse a "severe incident of construction project quality", rarely seen since New China was founded, and called for punishing those found responsible. Complete results of an official investigation are yet to be released. But construction experts - backed by photographs taken at the site - say faulty design, lax supervision and poor quality control were to blame for the collapse, though the weight of earth removed from beneath the building to build an underground car park initially seemed to have been the direct cause. The claim that the construction process was flawless - the building fell on its side, completely intact - sounds more like an ode to a murderer who has left his victim's body clean of blood. The Shanghai building collapse is just the tip of the iceberg. Corruption and gross irresponsibility run deep. But the collapsed building, which killed an unlucky migrant construction worker, may well be a sign to look deep into the problems plaguing the Chinese realty sector. Though we have laws and regulations stipulating buildings should be strong enough to stand for at least 50 years, it is not rare to see cracks in many. Reports of inferior quality materials being used for construction are too common to ignore. The China Sports Museum, completed in 1990 to coincide with the Beijing Asian Games, became a perilous structure after only 15 years. It is an irony that the building had won a top national award for construction. Property mogul Ren Zhiqiang once wrote that the average lifespan of residential buildings was about 30 years. That is why many of the buildings completed in the 1980s already require reinforcements, or have been demolished to give way to new buildings. And that is why many newly built structures collapsed in the Sichuan earthquake last year, while some built in the 1950s stood firm. In his blog, commentator Shi Hanbing attributes the worrisome situation in the property sector to greed. He recalls that during a TV debate he attended, one of the participating guests suggested brazenly that property developers cut the use of steel bars to save costs and make a profit. None of the developers present uttered a word of objection. Karl Marx, in a footnote to Capital, quoted a bourgeois British trade unionist T. J. Dunning: "Capital eschews no profit ... With adequate profit, capital is very bold. A certain 10 percent will ensure its employment anywhere; 20 percent will produce eagerness, 50 percent, positive audacity; 100 percent will make it ready to trample on all human laws; 300 percent, and there is not a crime at which it will scruple, nor a risk it will not run, even to the chance of its owner being hanged." More than 150 years have passed since these words were first said, they hold true to this day. The developers, nonetheless, would never dare to take such a drastic step - as using fewer than needed steel bars - without conniving with some government officials. The developer-official nexus is a fact, which Cheng Siwei, former deputy chief of the national top legislature, has admitted to. "Bribes paid by developers to officials account for up to 30 percent of the cost of property." Though there is no solid evidence, some reports say the names of some major shareholders of the Shanghai development firm are the same as the local township government officials'. The registered capital of the firm was reportedly only 8 million yuan, as compared with 800 million yuan worth of value of the residential bloc it was developing. It means the firm could have enormous profit margins with an ignorable amount of investment. It's getting clearer for us the public. The collusion between builders and some government officials is now deeper and murkier than before. (China Daily 07/04/2009 page4) |