|

OPINION> Commentary

|

|

China's challenge now to forge own path

By Kent G. Deng (China Daily)

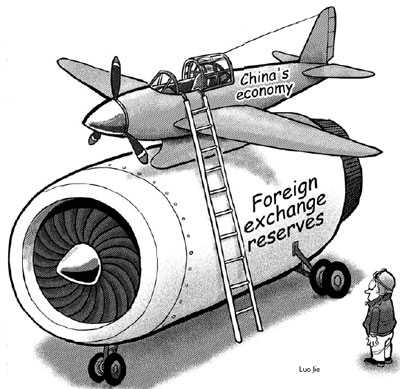

Updated: 2009-03-25 07:49 With 30 years growth China has been transformed from a closed, centrally controlled planned economy of scarcity to a large, open market economy. In the past decade or so, China has acted as the main engine of globalization. The prediction of Napoleon Bonaparte has finally come true: When China wakes, she will shake the world. China does so with cheap manufactures for the global market. The world price structure has changed as a result of China's economic power. The global financial meltdown started in the United States with a domino effect on the entire capitalist market economy. In the West, credit has been crunched; bankruptcy has rocketed; sales nosedived and company lay-offs have been wide spread. The problem for China is that the injured West has been China's symbiotic growth partner over the past three decades. If the West is down, can China stand alone? The immediate challenge during the current global crisis is China's huge foreign exchange reserves at $2 trillion (as in 2008), of which over $500 billion are American institutional bonds. In good times, buying American bonds is a sensible strategy as they yield secured returns. But now everything has changed. The American economy is falling apart. The Obama administration has an "economic-stimulus bill" to rescue the troubled economy. Other G7 countries have done similar things. But no one can guarantee their success. American bonds are increasingly viewed as a liability instead of an asset. Especially, if the American dollar and other main Western currencies lose value, China's foreign exchange reserves, American bonds included, will shrink. It means that a proportion of China's hard-earned foreign currencies from previous export success are inevitably going to evaporate. So, it is a bad time to hold these bonds. A way to turn it around is to purchase American assets in the form of factories, real estate and infrastructure not only because they are tangible but also because the prices are low in the current economic winter. However, any sizeable purchase on American soil faces socio-cultural constraints, as the price is only one of the many variables for a deal to go through. Other strings, especially political ones, are always attached. The Japanese experience in the 1980s is a good example. Typically, China will face the barrier of "national security" and "national interest" raised by various vested interest groups in the United States. It is a ball game completely different from the everyday commodity market. China's option seems to be "to cut its losses and run" in the secondary bond market. In hindsight, if China had invested in precious metals, it would have been in a very advantageous position today, as an ounce of gold is now worth well over $900. So, the old mercantilist wisdom still ticks. The second challenge is world commodity prices and demand. It took the market a decade to increase the oil price from $40 per barrel to $140 per barrel. But it took just a few short weeks to slide back to $40. The same trend is universal: prices dropping, some in free fall. The message is simply a neo-classical one: the world has over-produced for too long. And, no economy with over-supply can be sustainable. The main pillar to support high prices in the past two decades has been housing demand. What Western mortgage lenders have done is to artificially relax the income and price elasticity of the demand side in the name of making housing universally affordable with cheap loans, against inelastic supply of land. The mismatch has caused property prices to explode, which in turn has caused a huge inflationary push in building materials, energy, transport, wages and so forth. It is not surprising that such a boom has been translated into greater demand for "wage goods" or "household goods:" shoes, garments, toys and microelectronics that China is so good at producing very cheaply and able to flood the whole world with single-handedly. But with crashing bad debts in the Western housing sector, all the factors that contributed to the rising aggregate demand for wage goods or household goods are now in reverse. As a result, sales of China-made household goods have drastically declined.

The Chinese government's current response to promote domestic demand is a sensible strategy considering China is potentially the largest single market in the world. However, China's per capita income at its current level does not permit domestic demand to absorb its world-oriented supply. So, apart from contingency measures such as price subsidies and purchase coupons, China has to alter its industrial structure by systematically scaling down its output capacity of wage goods or household goods and increasing output of other types of products to match China's domestic needs. One area is services, such as providing more and better public transport, mass communication, hospitals and schools. Another is disaster prevention and relief against flood, drought, deforestation, desertification and pollution. But above all, China has a lot of room to improve in human capital by improving all levels of education to match advanced economies, and by providing all citizens with affordable medical care and decent pensions. These are all about a higher level of mass consumption. In other words, China has proved to the world that it can produce cheaply. It is time for China to show the world that it can also consume. It has been estimated that the current economic downturn will last for at least five years. Even after the world economy recovers, for the foreseeable future, in one way or another, trade protectionism will come back. Major Western currencies will almost certainly devaluate to boost their exports. The pressure on China to appreciate the renminbi will remain high to serve the same end. So, the world market will not only become smaller but also more competitive. In this regard, the real winner in the next round of global growth will not know how to work harder (as China has demonstrated) but how to work smarter (as the G7 countries have done with their technology). If so, upgrading human capital becomes imperative to change China from being a producer of low-end goods to the median level or the high-end market of capital goods and high quality services. The author is a researcher at the London School of Economics and Political Science. (China Daily 03/25/2009 page9) |