|

OPINION> Commentary

|

|

Low carbon economy or higher consumption?

By John Coulter (China Daily)

Updated: 2008-10-30 07:41 These days ordinary people in the street cannot go to the toilet without reading about the global financial crisis. Watching the news seems like the end of the world, and it should be for the Swinging Dicks who have gotten multimillion dollar bonuses for managing so much money, even when they juggle it till it crashes. Yet for China Central TV English news there is something else called the real economy which goes on and may only be marginally affected by the thrashing about of the bankers and fund gamblers. An alien observer in space would see most people going about their daily business and certainly eating almost the same, and maybe laughing and loving just as much. Basic life has not changed for most people, and those hurt are only those caught up in the extremes of cavalier lending and investment, and including as a flow-on, those ordinary workers unknowingly serving the pandered delusions of the financiers and their sub-sub-very-subprime borrowers. The bad statistics coming out of Wall Street are described as whopping, horrific and worst in history. The hundreds of billions of dollars said to be being made available for bailouts are surreal. Those dollars did not exist previously, they are not in the bank, and they do not represent goods or services already done, or taxes collected. They are made up. Money yet to be printed. Surreal. The discipline of economics has been sent mad by greedy people bent on their own self-interest and hiding behind a social science that has been turned into pseudo-science. In the past decades when bank loans executives were raking in commissions on loans signed, was the term subprime explained to any of the people now wincing at its mention? The connotation of the term is that it describes a loan that is less than top-shelf, just like 99.9 percent gold is not pure gold. Well, we now know that incentives were collected by aggressive salespeople on loans granted to borrowers hopelessly out of any position to repay. Housing loan to unemployable drug addicts? Not quite a prime loan scenario. Apparently this was not a crime in the past, no matter how stupid, unethical and immoral it would have appeared, even to the perpetrators. Alan Greenspan now admits part blame for lax regulation when he ruled the Federal Reserve.

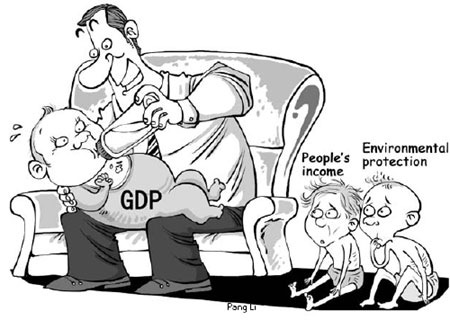

It may well become illegal soon, as it already is in most of Europe, Canada and Australia. But beyond this issue is a much deeper problem with the misuse of economic analysis, and the twisting of definitions. Good, thinking economists are quick to point out that the economy of a household, enterprise, a market, a region, nation and indeed even the global economy is a physical phenomenon. It is the producing of apples and oranges, bricks and cars, and the sweat of labor and the invention of technologies and rational strategies of entrepreneurs. And almost as an after-thought, it is joyfully conceded that since we cannot add apples to oranges, etc, the gross domestic product (GDP) is calculated in a common money currency. Just for convenience. This true convenience of being able to aggregate or compare different economic outputs in dollars is now through financial juggling mercilessly exploited to fudge and fake physical reality. Money can be detached from the goods and services it originally represented, so that a wealthy person may have indeed earned it, but also maybe inherited it, or won in a lottery, or enjoyed windfall profits, taken bribes, cheated for it, stole it and so on. Economists used to declare that prices are real, because they form at the intersection of supply and demand, and are therefore scientific and mathematically rational. That is before suppliers lent to buyers to increase sales volume and create an artificially high impression of value.  The world record price for a painting may well be due to the auction house lending half the amount to the buyer. Car and housing sales increase because of easy lending, and salespeople are rewarded, and are not in the picture when defaults occur. The current financial fiasco begs a rethink of why growth is the god of business, and why leaders are beholden to GDP increase. The notion of GDP was only conceived in the 1920s in research led by Simon Kuznets, not into the pursuit of production, but in a study of aggregating individual incomes to a national income. It was very natural to be interested in individual incomes and their national aggregate, and who will argue against finding ways to increase income. Basic economics acknowledges that income should be equal to what was produced, so the interest in increasing income led to a mindset of increasing production. On a farm, that is great and noble. When the service produced is cleaning up an oilspill, there needs to be a check on those now with a mindset that the more oil spills, and any disaster and even war, the greater the production, and higher the income. It may work for the provider of cleanup equipment, and military weapons, but there should be no cause for global glee. China has been led to the nexus of the debate on this dilemma. There are two arguments talking past each other, sometimes even from the lips of the one intelligent statesman. The environmental downside of China's 30 years world record development can no longer be ignored. The Scientific Outlook on Development, its emphatic promotion right now, the passing of the Circular Economy Promotion Law, and the entire push for clean production and energy efficiency are all serious and will effect change for the next decade. Yet the growth mindset, as depicted by statistics, is so overpowering that when markets fail hugely, there is a penchant to play with more numbers, and find levers to shore up growth figures. The new blind strategy is that, okay, export destinies have closed up so we can drive consumerism at home. This, also termed domestic demand, means different things to mathematical economists and strategic statesmen. For the former, all domestic demand is good - billions of dollars for computer games, bigger air conditioners and cars, flashier clothes and homes. For the strategic statesman, the low carbon economy, energy efficiency, recycling, lowering of consumption of raw resources through technical efficiencies, can lead, if not necessarily to booming growth figures, certainly a better quality of life as monitored via the Scientific Outlook on Development. The initiative to help re-boost the economy through major strategic investments in railway is brilliant. Efficient transport is a great enabler for China's geographically expansive economy. The simple fact is that in the US the financial markets have been unregulated and usurped by greedy crooks who felt rewarded by their bravado, and felt no restraints until recently. For the Chinese economy, now that US buyers can no longer afford the cheap toys, white goods, electronics, clothes and myriad other goods and goodies that were racked up on easy stretch credit, the antidote is to revert to an appreciation of the real physical economy, based on realistic appreciation of goods and services, based on the fundamentals. Two and half thousand years ago Taoism of Laozi pointed out poignantly, and succinctly yet cryptically, that Man and Nature are one, as depicted in the intertwining swirls of the finite circle, which certainly can be imagined to symbolize our finite global resources fixed in the biosphere of our planet. The number of atoms of the critically useful and essential element, carbon, fixed in our biosphere is finite, and can be tracked as they flow from hydrocarbons to carbon dioxide then (now only in part) back to carbohydrates in vegetation. Any attempt to play with numbers of dollars, even trillions, to address the global financial crisis, without feet on the ground in understanding the necessity for a low carbon economy, will not solve, but only acerbate the aberration between the real physical economy and the money mirage that Wall Street has been dancing in. The author is a Beijing-based, independent Australian researcher collaborating with Tsinghua University and China Agricultural University (China Daily 10/30/2008 page9) |