US subprime cold could make Japan sneeze

By Liu Junhong (China Daily)

Updated: 2008-04-24 07:19

Updated: 2008-04-24 07:19

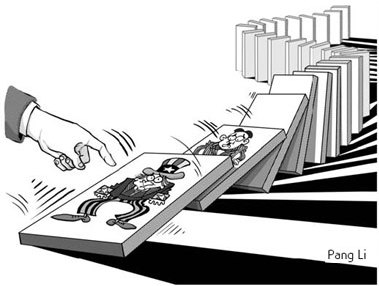

The US subprime crisis is deeply affecting the world economy through the international financial market. As the second largest economy in the world, Japan is under the spotlight as the world wonders how the Japanese economy is holding up, what its prospects look like and if it is ready to step in as the main replacement engine for the world economy when the US falls into a prolonged economic slump.

It is an undeniable fact that Japan's economy is also hit by the US subprime debacle, but not in the same way or as seriously as other countries and regions are affected. This is mainly because Japan's is considerably different from other capitalist economies in terms of format. The pros and cons of this Japanese format aside, it has in a way served as a "firewall" in the present crisis.

First of all, Japan is still miles behind the US in terms of financial liberalization, with relatively few financial institutions seriously infected by the "subprime virus". Second, Japan was quite late to introduce debt obligations into the security market, which is too small to hurt the country's financial system even if the debt market turns bad. Third, Japan's financial system remains an "indirect" entity in nature despite a decade of reform, or a "market-oriented indirect financial system" at best.

Under such a financial system the government enforces strict control and the development and operation of new financial products is subject to stringent government scrutiny.

There is no question that Japan's financial system is inherently less efficient than other capitalist economies', but it is working as a "firewall" against the onslaught of the US subprime "virus" this time around.

For the Japanese economy the US subprime fiasco is both good and bad news. The bright side is that the subprime crisis has exposed the handicap of "financial capitalism" championed by America, meaning the US-led financial globalization and liberalization is now approaching a critical state.

Back in 1993 the Clinton administration described the "Japanese economic format" as "mutant capitalism" and forced Japan to undergo socio-economic reforms to open up its financial market, while the country's economic bubbles burst.

After George W. Bush moved into the White House in 2001, his administration was constantly on Japan's back, urging Tokyo to establish a "bad-debt market" and let American capital in freely in the name of "helping" Japan sort out "bad debts". The real purpose, though, was to profit from the mortgaged assets behind the bad debts.

This in fact led to a face-off between the two leading economies' financial development formats, with Japan's emerging the winner as the US' is weakened by the subprime cave-in. In view of this outcome, some Japanese scholars have begun to call for the development of a "market-oriented indirect financial system" with Japan at the helm.

The flip side of the matter is that Japan's economy will now face multiple challenges as a result of the chaos on the international financial market caused by the US subprime mess, which has also disrupted the global financial system and could set the world economy back a step or two.

The Japanese economy is hopelessly dependent on foreign markets and therefore cannot but be affected by the US economy. If the latter stalled long enough for the world economy to lose steam as well, it would only be a matter of time before Japan's exports feel the pinch and its economy crumbles.

This is because the growth pattern of Japan's economy is saddled with two vital flaws that make it impossible for the island nation to stay clear of the US economic fits. One flaw lies in the fact that Japan's economy is overly reliant on overseas markets, including the US, Europe and emerging ones like China.

The close link between the US and Chinese markets and the fact that a lot of Japan's export items to America are made in China have determined Japan relies heavily on two routes for exports to the US - via China and directly from Japan. When the US economy stalls and causes market demand to wither, Japan's exports to America, directly or through China, will inevitably suffer.

The other flaw is found in Japan's shrunken working population, which is seriously hampering the expansion of the country's domestic market. This means it is extremely difficult for the Japanese economy to survive on the domestic market alone when its export markets go on a diet.

In terms of policies, Japan's current fiscal deficit is a little more than 5 percent, while its policy interest rate is at a super low level. This means the Japanese government cannot do much to boost domestic demand by way of financial policies when the US economy stalls and the overseas markets contract.

All this means it is very hard for Japan to be immune to "subprime-triggered complications" despite its success in fending off the "subprime virus". And the so-called Japan-US economic separation theory just doesn't hold water.

The subprime crisis is also responsible for messing up the international financial system, which has caused a panic run by surplus capital worldwide from the "disaster areas" to commodity markets and set prices of resources soaring. The rising prices of oil, iron ore and coal will no doubt add to external costs of Japan's economic growth.

The growing cost of resources is bound to be passed on to lower links of the economic food chain and weigh the country's economic growth down. As a matter of fact, the oil firms in Japan have already begun transferring increased costs to industries downstream.

The problem is that the country's ruling and opposition parties are both clamoring for using state revenue to subsidize the industries these days, raising fears the government would lose its macro-control capabilities when its wallet is empty.

Then there is the sore thumb called exchange rate. The US subprime earthquake has driven huge amounts of Japanese capital back home from overseas money pools and caused the yen to appreciate. This is really bad for Japan's exports and therefore the whole economy, which is dangerously dependent on overseas markets.

The author is a researcher with China Institute of Contemporary International Relations

(China Daily 04/24/2008 page9)

|

|

|

|