US vote softens China's anxieties

Updated: 2011-08-02 14:17

By Li Xiang and Li Xing (China Daily)

|

|||||||||||

Debt-ceiling bill clears first hurdle in House

BEIJING / WASHINGTON - With the US government on the brink of a default, the last-second deal to raise the debt ceiling and slash the federal budget weakened by the Republican Party's political hijacking cleared its first obstacle on Monday as the House of Representatives passed the legislation by a 269-161 vote.

|

|

The Senate will vote on the bill at noon Tuesday. If passed, the legislation would then go to US President Barack Obama for his signature to avert a default. Approval in the Senate is considered likely.

The House vote was highlighted by a surprise appearance by Rep. Gabrielle Giffords, making her first appearance in Congress since suffering a head wound in a shooting six months ago. Giffords voted in favor of the bill.

The agreement reached by US lawmakers to raise the debt ceiling may have eased investors' concerns in the US, but China, the largest foreign holder of US debt, still faces the challenge of diversifying a massive foreign exchange portfolio endangered by a weakening dollar, economists said.

Though details of the legislation were released later Monday, the plan's framework would raise the $14.3 trillion borrowing limit and cut an initial $1 trillion from federal government deficit spending over the next 10 years.

Related: Weak dollar may lift China inflation

Although China has not officially responded to Washington's latest plan to address its debt problem, analysts said that Beijing is likely to view the plan as a positive step in restoring investor confidence in the dollar and US bond market.

"It certainly is a relief for China," said Chen Daofu, a director at the State Council's Development Research Center.

Japan, the second-largest holder of US debt, also welcomed the deal and said that it hoped that the US could take further steps to stabilize financial markets.

But economists said the legislation's effects to help prevent a possible downgrade in the US' credit rating is still in doubt.

International rating agency Standard & Poor's has warned that it could downgrade the US' rating even if the debt ceiling was raised by Tuesday's deadline if a "credible solution" to the rising US debt burden is not achieved.

The US economy grew by 1.3 percent in the second quarter, far lower than the expected 1.8 percent. Economists said that underlying growth has probably been flattered by the massive quantitative easing, the money-printing program launched by the Federal Reserve.

"A failure for the US to return to robust growth would be bad for the global economy even if the major emerging-market countries have attained self-sustaining growth," Joseph E. Stiglitz, a Nobel laureate in economics and professor at Columbia University, warned in a recent article.

"We still cannot rule out the possibility of a downgrade of the US credit rating if Washington fails to come up with a long-term and balanced solution to address its debt problem," Chen said.

"For policymakers in Beijing seeking alternative ways to invest the massive foreign exchange reserves and to reduce its rapid accumulation remain the crucial challenges," he said.

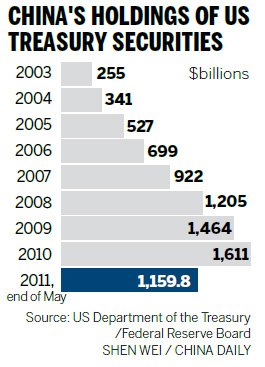

China's foreign exchange reserves rose by a faster-than-expected 30.3 percent year-on-year by the end of June to reach $3.2 trillion. The country increased its holdings of US Treasury bonds by $7.3 billion to $1.16 trillion in May, the second straight month it increased its US debt holdings, according to the US Treasury Department.

Yu Yongding, a former adviser to the People's Bank of China, has repeatedly called on the government to reduce the holdings of US Treasury bonds and to halt future purchases as the dollar will probably continue to weaken.

But some analysts said that a massive sell-off of US bonds would be financial suicide for China as it would drive down the value of its own holdings.

Tan Yingzi contributed to this story.

China Daily