Society

Putting great store in Sino-UK ties

By Xin Zhiming, Qin Jize, Zhang Haizhou and Zhang Chunyan (China Daily)

Updated: 2010-11-10 07:21

|

Large Medium Small |

A Perfect Fit

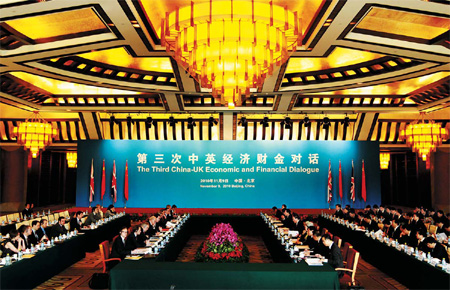

Also on Tuesday, Vice-premier Wang Qishan and Osborne jointly chaired the third China-UK Economic and Financial Dialogue and announced a slew of cooperative programs for the coming years, including in the areas of trade, finance, high-technology, infrastructure, low-carbon economy and cutting emissions.

China is the world's largest exporter of goods while Britain is the second largest exporter of services, which means the two have promising cooperative opportunities in a wide range of fields, Osborne told the media after the meeting. "Our economies are complementary," he said.

That could be a positive signal for China's $200-billion sovereign wealth fund, China Investment Corporation (CIC), said analysts.

The CIC has been shown the cold shoulder in some countries because it is feared that the financial giant could disrupt markets and grab key resources, despite its reiteration that it is aimed at long-term investment that would stabilize financial markets.

Britain also affirmed that it would support China's full market economy status "as early as possible" and will continue to "play a constructive role to encourage EU recognition", according to a statement released following the dialogue.

Analysts claim that developed economies, such as the United States, have taken advantage of China's lack of such a status to impose trade measures more easily on Chinese exports.

China and Britain will also strengthen cooperation in taxation policies, statistics, energy, finance and civil aviation, reads the statement.

|

|

Words of Warning

Outside of the Great Hall of People in Tian'anmen Square, the flags of China and Britain flew side by side - and it is in this fashion that the two nations have vowed to push global economic recovery.

"The priority (for the world) is to enhance macroeconomic policy coordination, oppose all types of protectionism and avoid economic issues from being politicized to benefit all-round recovery of the world economy," said Vice-premier Wang Qishan.

However, experts warn the recovery could be jeopardized by the quantitative easing policy of the US as it may push up inflation in the developing countries and cause chaos in the financial markets.

"The large amounts of capital into the emerging market economies will lead to rising inflationary risks," said Wang during the China-UK dialogue.

The US Federal Reserve has released its latest quantitative easing policy by buying $600 billion in government bonds to keep borrowing costs near zero and prop up the ailing economy. A number of countries have expressed concern about the expected liquidity boom.

China and Europe may discuss the impact of the quantitative easing at the G20 summit in Seoul.