China acts 'responsibly' in its currency reform

Updated: 2007-12-11 07:23

China has reformed its foreign exchange regime with utmost responsibility, and further reforms will be pursued in accordance with evolving national and international conditions, analysts have said.

Currency is expected to be one of the subjects atop the agenda of the third China-US Strategic Economic Dialogue (SED) scheduled for December 12-13.

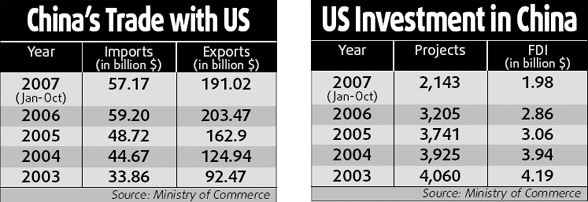

The US and the EU, which blame their trade deficit on China's foreign exchange rate, have stepped up pressure on the country to revalue its currency at a faster pace.

"The pace of change has accelerated, but they need to move it more," US Treasury Secretary Henry Paulson said last week, referring to China's exchange rate.

Some US Congressmen have proposed more than 50 legislative bills related to China-US economic ties.

"China should listen to other partners' concerns, but they should also listen to what China has to say," Renmin University of China's finance professor Zhao Xijun said.

"The SED is not a negotiating table but a forum at which the two sides can better understand each other and understand the logic behind their respective policies," Zhao said.

Since the landmark foreign exchange reform in July 2005, when China depegged the yuan from US dollar and shifted it to a basket of foreign currencies, the yuan has gained 11.9 percent. And it has risen 8 percent since Paulson became US Treasury Secretary in July 2006.

The exchange rate policy, Zhao said, has to conform to changing domestic and international conditions and should be worked out in the best interest of the world economy instead of just a single economy - be it the US or the EU.

The country's currency reform, analysts say, needs time. "When the conditions warrant quick revaluation, we can move quickly; and when they are suitable for slower revaluation, we have to move moderately," Zhao said. "The pace should depend on the conditions and not be set arbitrarily."

Revaluation of the yuan, some experts argued, would not necessarily reduce China's trade surplus and its foreign currency reserves.

"The processing industries, many of which import parts and export finished products, are the main drivers behind China's trade surplus so the appreciation would not necessarily curb it because a revaluation could also make the imported parts cheaper, and encourage the processing industries to import more," China Galaxy Securities chief economist Zuo Xiaolei said.

Some Chinese experts, however, favor a "speedy revaluation" of the yuan. "The relatively speedy revaluation (of the yuan) can help curb inflation, which has been rising," Peking University professor Xia Yeliang said.

|

|

|

||

|

||

|

|

|

|