Bumpy ride, but global sales rising

Updated: 2012-08-13 08:04

By Gong Zhengzheng (China Daily)

|

|||||||||||

|

BLG Logistics workers check new cars shipped by train to the port at Bremerhaven, Germany. Eurozone concerns now weigh heavy on the region's markets. Provided to China Daily |

Consultancy: 90% of Asia growth from China in 2013

Global light vehicle sales are expected to be bullish this year and in 2013 despite mounting risks, according to industry consultancy LMC Automotive.

The company with offices in the US, the UK, Germany, China and Thailand predicted last week in a report that global light vehicle sales will total 79.4 million units this year, up 5 percent from 2011.

Sales through the first half of the year point to a very robust full-year projection of 80 million units as major markets including the US, Japan and China outpace sales of a year earlier, it said.

But the pace is expected to slacken in the second half as economic growth in both emerging and mature markets is expected to slow.

"As the level of uncertainty rises as the result of the European debt crisis and its impact on other markets, so does the amount of pressure on auto sales around the world," said Jeff Schuster, senior vice-president of forecasting at LMC Automotive.

"All eyes are on Europe for a signal of the direction, as volume growth holds in 2012 but remains at risk next year," Schuster added.

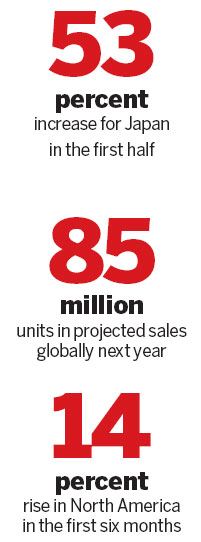

The company said global light vehicle sales next year are poised for a 6 percent gain to almost 85 million units. Many markets are expected to continue to be dynamic, which puts downward volume risk in 2013 at 3 to 5 million units globally.

Asia

The light vehicle markets across Asia ended the first half of 2012 in positive territory, with year-on-year growth led by Japan, up 53 percent as the market recovers from the 2011 disaster, propelled by tax incentives for fuel efficient vehicles.

China sales remained strong in the first half, with an increase of 6 percent.

Thailand continues to recover considerably from the floods in 2011, with first half light-vehicle sales volume up 40 percent from the same period in 2011.

India posted a 14 percent growth, but the month-over-month selling rate declined during the past four months.

For 2012, sales in the region as a whole are projected at 33.4 million units, up 10 percent from 2011.

As China and India's economies begin to cool and exports to Europe slow further, there remains risk of weaker auto sales in the remainder of 2012 and into 2013. Sales in China are forecasted at 19.5 million units and India is expected to sell 3.2 million units. Combined, volume risk is in the 500,000 unit range for this year.

Light vehicle sales in Asia are expected to grow to nearly 37 million units in 2013, with China representing 90 percent of the growth, on the likelihood that the government will increase investment spending and launch a vehicle subsidy program in rural areas.

Europe

Weakness has plagued Europe, as light-vehicle sales in Western Europe fell 8 percent in the first half of 2012.

Economic recession and concerns over the future of the eurozone have weighed heavily on the region's vehicle markets.

Among the five key markets in Western Europe, there has been a divergence between the relatively better performing markets in the United Kingdom and Germany and those of Spain, France and Italy - the latter two hit by double-digit percentage declines so far in 2012.

"The pressure in the European market is immense at the moment as the auto industry struggles with falling sales volumes, increased discounting and idle plant capacity," said Jonathon Poskitt, head of European sales forecasting at LMC Automotive.

"The risk of the eurozone crisis worsening threatens any meaningful recovery in the near-term, and even the German market is showing clear signs of a slowdown."

Sales in the region are projected to decline 5 percent to 18.2 million units this year. The 8 percent drop in Western Europe is expected to be offset by a 4 percent increase in Eastern Europe and the Russian market benefiting from higher oil prices earlier in the year.

For 2013, light vehicle sales are expected to grow by 2 percent if the eurozone storm is weathered, but could decline by 2 million units if a costly break-up occurs.

North America

In contrast to the year-to-date declines in Europe, the North American market jumped by 14 percent during the first half of 2012, with the United States and Mexico increasing by double digits - 15 percent and 12 percent respectively - and Canada not far behind with a 7 percent increase.

"The US and Canada posted stable selling rates in July, but the growth rate for the remainder of the year is no longer expected to be as strong, as the economy cools and concerns with Europe rise," said Schuster.

"However, we do expect the North American market to be able to ride out the potential storm, albeit at a lower level."

As a result of higher economic-driven risk, LMC Automotive is lowering the 2012 light vehicle forecast for the United States to 14.3 million units from 14.5 million units. In addition, the 2013 forecast has been tempered to 15.0 million units from 15.2 million units.

South America

Even as the economic outlook has been downgraded, light-vehicle sales have increased sharply over the last two months in Brazil as the August expiration of the temporary cut of IPI tax - a federal tax applied in selling and transferring goods - has driven an increase in volume.

Even with the significant increase, volume in Brazil for the first half of 2012 was down 4 percent from the same period last year with a selling rate of 3.3 million compared with 3.5 million last year.

Argentina averaged a selling rate of 777,000 in the first half of 2012 with volume down 10 percent from the same period in 2011.

For the full year, sales in the region are projected at 5.3 million units, 100,000 units short of 2011 volume.

If the Brazilian tax cut is extended until December, the market could see a boost, bringing 2012 sales to the level of those in 2011. However, this would have a negative pull-ahead impact on 2013 light vehicle sales.

The forecast for South America in 2013 is for an increase of 6 percent to 5.7 million units, driven by expected economic growth in the run-up to the 2014 World Cup in Brazil.

gongzhengzheng@chinadaily.com.cn