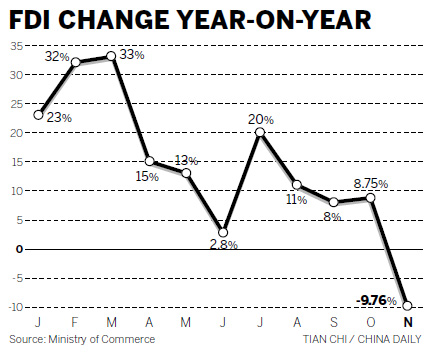

First FDI drop in 28 months

Updated: 2011-12-16 10:44

By Ding Qingfen (China Daily)

|

|||||||||||

Vice-Premier Li calls to promote consumption and service sector

BEIJING - Foreign direct investment (FDI) fell almost 10 percent last month from a year earlier, the first drop in 28 months, as Vice-Premier Li Keqiang called for a boost to domestic consumption on Thursday.

|

|

Amid the "grim and complicated" global outlook, China needs to strengthen market capacity and growth by encouraging private investment, increasing investment in affordable housing projects and accelerating urbanization, Li said.

The vice-premier also called for greater promotion of the service industry, which he said is the largest "employment creator and innovation driver".

Experts said a growing and stable Chinese market will help lure foreign investment, and they predicted that the world's second-largest recipient of foreign investment will recover lost ground in the long run.

According to the Ministry of Commerce, FDI fell 9.76 percent from a year earlier to $8.76 billion in November.

China last witnessed a monthly drop in FDI in August 2009 amid the world's worst financial meltdown in seven decades.

"The only thing that explains the drop in November is that the debt crisis in the European Union and the US economy have both taken a toll in the confidence of foreign investors," said Zhu Baoliang, chief economist at the State Information Center, a government think tank.

From January to November, US investment in China dropped by 23 percent year-on-year to $2.74 billion, and investment from the EU rose marginally by 0.29 percent to $5.98 billion.

Shen Danyang, ministry spokesman, said the monthly figure may not reflect the long-term trend, which he described as positive.

"The drop in any individual month is not representative and does not define the general trend of Chinese FDI growth amid sluggish global investment," Shen said.

A number of factors, including stable economic growth and domestic consumption potential, show China's long-term advantages and appeal to foreign enterprises, he said.

He also said investment from developed countries will grow over the long term.

Opening wider

Shen said China's commitment to opening its market wider will help attract more investment, with high-tech and green industries offering golden opportunities for foreign firms.

"China will encourage foreign enterprises in the next five years to invest in modern agriculture and services as well as high-end and the energy-saving and environmental protection sectors," Shen said.

President Hu Jintao reaffirmed China's policy to open up as he said the policy had benefited both China and the world.

Under the agreements China recently signed with eight nations, including Germany, France, Switzerland, the Netherlands and the United Kingdom, enterprises from these countries, especially those in green industries, will increase investment in China.

During the three-day annual Central Economic Work Conference that concluded on Wednesday, China vowed to maintain relatively fast growth and to boost domestic consumption.

"There are no other places that can outperform China for investment," said Li Xiaogang, director of the Foreign Investment Research Center at the Shanghai Academy of Social Sciences.

"At the moment, investors may be reluctant due to the global outlook."