Manufacturing expected to still contract in Dec

Updated: 2011-12-16 09:36

By Chen Jia (China Daily)

|

|||||||||||

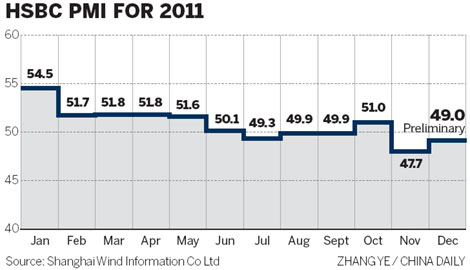

BEIJING - China's manufacturing sector is expected to maintain its contraction in December, according to the reading of the preliminary HSBC Purchasing Managers' Index (PMI), which came in at 49 on Thursday.

The contraction may prompt the government to alter its policies to those more oriented towards growth.

The estimated PMI is 1.3 points higher than HSBC's final November index of 47.7, which was the sharpest fall since March 2009, indicating that the manufacturing sector is shrinking at a slower rate than previously. A reading below 50 means contraction, while one higher than 50 indicates expansion.

HSBC's PMI figure was lower than 50 in each month between July and September, before rebounding to 51 in October, indicating that economic growth is slowing.

"Although the pace of the slowdown stabilized in December, the manufacturing sector remains weak, with additional downside risks," said Qu Hongbin, chief China economist and co-head of Asian Economic Research at HSBC Group.

Qu said that a rapid decline in exports and the cooling property market were the main forces dragging on the world's second-largest economy. He also predicted that the downward trend is likely to accelerate next year.

Meanwhile, a preliminary sub-index of manufacturing output rebounded to 49.5 in December from 46.1 in November.

"The Chinese government can and should be undertaking more aggressive easing on both the fiscal and monetary fronts to stabilize growth and jobs," said Qu, who said that inflation is unlikely to pose a threat to economic growth next year.

China's annual three-day Central Economic Work Conference ended on Wednesday with a statement that set the tone for economic policy in the coming year. It said that the country will "maintain basically steady macroeconomic policies, as well as relatively fast economic growth".

However, analysts said that the markets may be disappointed because the statement failed to mention either policy easing or a significant improvement in liquidity.

"The PMI readings are likely to remain below 50 in the first quarter of next year because a quick turnaround in policy is unlikely to happen, barring a sudden demand shock from Europe," said Stephen Green, a senior economist with Standard Chartered Bank PLC.

Green suggested that the monetary policy easing should be a gradual process, in light of the fact that inflation may begin to rise again after mid-2012.

In a recent research note, Zhu Haibin, chief economist with JPMorgan Chase Bank (Hong Kong), wrote that China's year-on-year GDP growth in the last quarter of this year may slow to 8.1 percent, compared with 9.1 percent in the July-to-September period. It may also decline further to 7.6 percent in the first three months in 2012.