HK investors jittery over US, Euro zone economy

Updated: 2011-08-11 10:14

(Xinhua)

|

|||||||||||

|

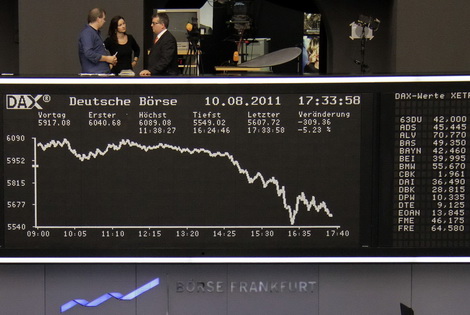

People stand at the balcony above the DAX index board at Frankfurt's stock exchange August 10, 2011.[Photo/Agencies]

|

Where the market goes depends on the external environment, especially whether the United States and the Euro zone can fix the debt problem, as well as their real economy, analysts said.

Jiang said the short-term impact on the stock markets from the US debt rating cut has come to an end, but the long-term influence remains to be seen.

He said: "S&P made a very brave judgment, which will force the US and European governments to face the fact and try hard to fix the debt crisis and other problems."

Jiang said whether the United States and the Euro zone can introduce effective rescue measures to convince the markets in the short, medium and long run, is the key factor in shaping the future of the stock markets.

As intensifying debt crisis has spread to Italy and Spain. Chan said the European Union has to expand the stabilization fund to provide the two countries enough support, and that needs approvals from all the EU members.

Chan said the outlook of Hong Kong's stock market is still not clear before the EU members reach an agreement in the coming October.

In addition, Chan expected the European economy to enter a shrinking period and thus drag the global economy.

Chan said the stock markets cannot perform well under the weak economic environment. He also has concerns that the potential capital outflow may be challenging to Hong Kong's market.

Related Stories

Hong Kong stocks close 2.34% higher--August 10 2011-08-10 16:59

Hong Kong stocks down 6.01% by midday 2011-08-09 13:50

Hong Kong stocks close 4.29% lower 2011-08-05 16:47

Hong Kong stocks close 0.49% lower--August 4 2011-08-04 16:45

- Disney Shanghai discloses operation mode

- China's July fiscal revenues rise 26.7%

- Tests find oil used by KFC not harmful

- China July cotton imports up 30.89% from June

- China set for massive rise in hotel numbers

- Hong Kong stocks fall 2.35%

- Media Markt plans larger network

- Shenhua Group in $8b Xinjiang coal projects