Statistics

China's consumer inflation hits 32-month high

(Xinhua)

Updated: 2011-04-15 10:17

|

Large Medium Small |

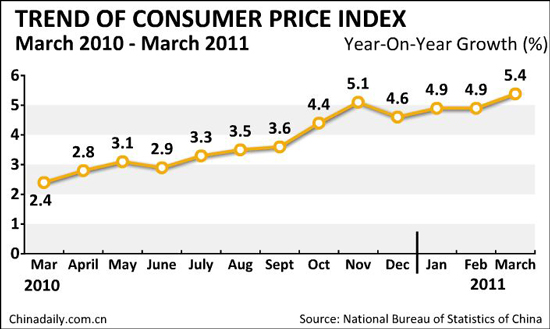

BEIJING - China's consumer price index (CPI), a main gauge of inflation, rose 5.4 percent in March from a year ago, a 32- month high, the nation's statistic agency said on Friday.

CPI stood at 5 percent for the first quarter, according to the National Bureau of Statistics (NBS).

Food prices, which accounted for a third of the basket of goods in China's CPI calculation, surged 11 percent year on year. Housing costs jumped 6.5 percent.

"Imported inflation has strongly contributed to the domestic price hike," NBS spokesperson Sheng Laiyun told a press conference.

Prices of crude oil, iron ore and grains rocketed to the highest in two years in March.

"To contain CPI growth to 5 percent for the quarter is a hard-earned victory amid abundant liquidity globally and widespread inflation in emerging economies," Sheng said.

He said China's March inflation data was still lower than 6.3 percent for Brazil, 9.5 percent for Russia.

Sun Chi, an analyst with the Nomura Securities, said inflation pressure would persist for a period of time, which indicated it was only early days in the monetary tightening circle.

| ||||

Chinese Premier Wen Jiabao said Wednesday that keeping the price levels basically stable was the primary and most urgent task for the government's macro economic control this year.

"Judging from the inflation situation in the first quarter, we are still under great pressure of price hikes," Wen said, adding, "We should never lower our guard."

Wen expected inflation pressure to continue in the coming months due to soaring commodity prices around the world, higher food and housing prices, and higher labor costs in China.

The People's Bank of China, the central bank, announced the second interest rate hike this year on April 5. It was also the fourth increase since the start of 2010.

After the increases, the one-year deposit interest rate will climb to 3.25 percent while the one-year loan interest rate will reach 6.31 percent.

To mop up the excessive liquidity that helps fuel inflation, China's central bank has raised the reserve requirement ratio for commercial banks nine times since the beginning of last year.

Despite the heightened cooling measures, domestic money supply remained abundant, as the central bank announced on Thursday that the broad money supply (M2), which covers cash in circulation and all deposits, increased 16.6 percent year on year in the first quarter of 2011, up 0.9 percentage points from February.

The new yuan loans increased to 679.4 billion yuan ($103.98 billion) in March from 535.6 billion yuan in February.

Liu Qiyuan, an analyst with the Qilu Securities, expected more tightening moves will come with the interest rate hikes as early as Friday evening, or as late as the end of April.

But Sun Chi warned the government be cautious of anti-inflation measures as they could put a sudden brake on the fixed-asset investment and might lead to a "hard landing" of the world's second-largest economy.

China's economy expanded 9.7 percent in the first quarter of 2011 from a year earlier, and 2.1 percent from the previous quarter.

| 分享按钮 |