Top Biz News

Savers switch to equities

(China Daily)

Updated: 2010-03-18 10:47

|

Large Medium Small |

SHANGHAI - Investors opened the most accounts to trade Chinese stocks last week in three months as households shifted funds into equities to protect against faster inflation.

Individual investors opened 352,203 accounts, data from the nation's clearing house showed on Wednesday, the most since the week ended Dec 11 and a third straight gain.

Consumer prices jumped 2.7 percent last month, government data showed, exceeding the 12-month household savings deposit rate of 2.25 percent. The number of households expecting inflation to accelerate in the next three months increased, the central bank said on Tuesday, citing a quarterly survey.

"Real deposit rates have now fallen into negative territory, so it would not be surprising if Chinese savers decide to chase better returns elsewhere," said Brian Jackson, an emerging-market strategist at Royal Bank of Canada in Hong Kong.

New accounts have yet to rise to last year's peak of 700,617 accounts opened in the last week of July.

Bloomberg News

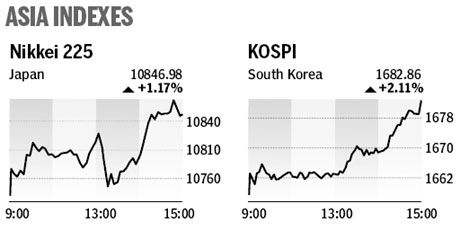

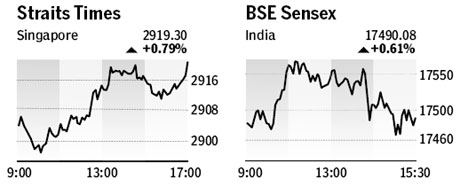

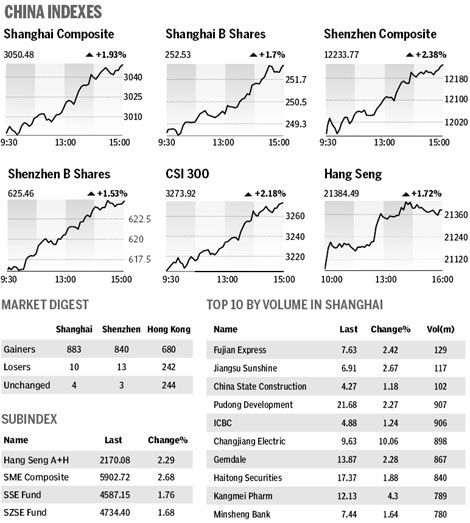

Market roundup