|

| |||||||||||

|

|

Major Macro Economic Statistics | ||||||||||

| Growth indexes | Price indexes | ||||||||||

| FDI: +7.79% | CPI: +1.5% | ||||||||||

| Power consumption: +40.14% | PPI: +4.3% | ||||||||||

| Foreign trade indexes | PMI: 55.8 | ||||||||||

| Import: +85.5% | Housing prices: +9.5% | ||||||||||

| Export: +21% | Financial indexes | ||||||||||

| Trade balance: -63.8% | New loans: -14.2% | ||||||||||

| M2: +25.98% | |||||||||||

|

CHINA ECONOMY BY NUMBERS (Monthly Issue) | |||||||||||

| January | February | March | |||||||||

| April | May | June | |||||||||

| July | August | September | |||||||||

| October | November | December | |||||||||

| Data and Graphic | |||||||||||

|

|

China's foreign trade up 44.4% in Jan China's foreign trade posted a 44.4 percent growth in January year-on-year, the General Administration of Customs (GAC) announced on Feb 10. Exports in January stood at $109.47 billion, up 21 percent from a year earlier, while imports rose 85.5 percent to $95.31 billion. [Full Story]

| ||||||||||

|

|

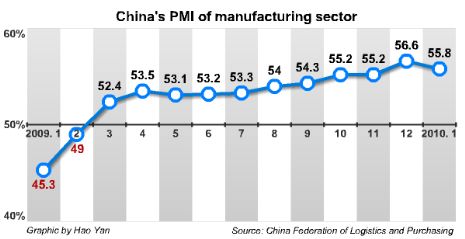

China's PMI of manufacturing sector down in Jan The Purchasing Managers' Index (PMI) of China's manufacturing sector stood at 55.8 percent in January, down 0.8 percentage points from the previous month, the China Federation of Logistics and Purchasing said on Feb 8. It was the 11th straight month for the index to stand above 50 percent, indicating continuous expansion in China's manufacturing industry. [Full Story] | ||||||||||

|

|

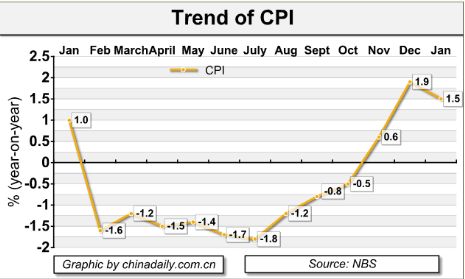

China's January CPI rises 1.5% China's consumer price index (CPI), a main gauge of inflation, increased by 1.5 percent in January from a year earlier, the National Bureau of Statistics (NBS) announced on Feb 11. The increase rate was 0.4 percentage points lower than the previous month. China's CPI rose 1.9 percent year on year in December last year, as freezing weather since November helped push up food prices. [Full Story] | ||||||||||

|

|

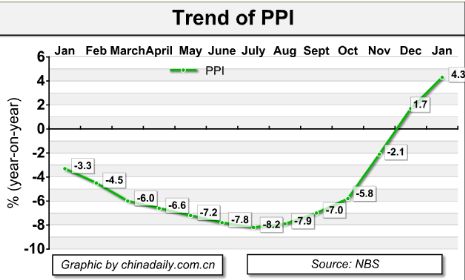

China's January PPI up 4.3% China's producer price index (PPI), a major measure of inflation at the wholesale level, increased by 4.3 percent year-on-year in January, the National Bureau of Statistics (NBS) announced on Feb 11. [Full Story] | ||||||||||

|

|

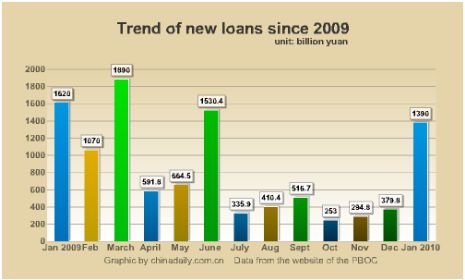

China reports 1.39t yuan of new loans in January China's new yuan-denominated lending in January stood at 1.39 trillion yuan ($203.5 billion), down 14.2 percent from a year earlier, the People's Bank of China (PBOC, the central bank) said Feb 11. In January last year, Chinese financial institutions issued a total of 1.62 trillion yuan in new loans. In total, China's yuan-denominated lending in 2009 hit a record 9.59 trillion yuan, almost double that of the previous year. [Full Story] | ||||||||||

|

|

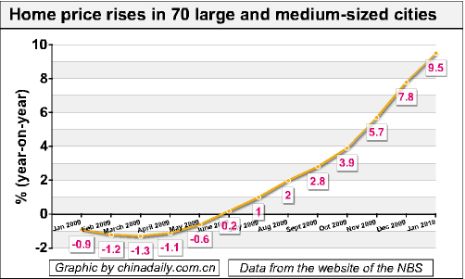

China's housing prices up 9.5% in Jan Housing prices rose 9.5 percent in January from a year earlier in China's 70 large and medium-sized cities, said the National Bureau of Statistics on Feb 11. That was 1.7 percentage points higher than December's housing price rise, or the highest increase in 21 months. Housing prices increased 1.3 percent from December in these cities. That was 0.2 percentage points lower than December's month-on-month rise. [Full Story] | ||||||||||

| Opinions related to China's economy | |||||||||||

|

More explanations needed on higher prices The possibility is very high that you will find that the prices of nearly everything are picking up nowadays. Why? The traditional Spring Festival is coming. But it is not the sole reason. Since November, the country's consumer inflation has surged into the positive territory, and recent data shows the trend may have become entrenched. What's more, many people feel price rises are even higher than the data show.[Full Story] | |||||||||||

|

China moves to curb housing prices amid bubble fears Chinese authorities have moved to curb soaring property prices, amid concerns that speculation and explosive growth in bank lending have caused an asset-price bubble. In one of the latest moves, several major banks have toughened lending rules for property developers and reduced 2010 loan quotas. [Full Story] | |||||||||||

|

What's next for China's monetary policy? China has begun moving at the margins to withdraw excess cash from the financial system, as a spike in lending in the first few weeks of the year prompted concerns that credit growth was getting out of hand. The moves, which have included increasing banks' required reserves as well as additional punitive reserve requirements for some lenders, have prompted jitters in global markets as investors worry that tightening in the world's third-largest economy could drag down growth both in China and elsewhere. [Full Story] | |||||||||||