Medtronic eyeing M&A possibilities with local firms

Updated: 2011-08-05 16:55

By Liu Jie (China Daily)

|

|||||||||||

|

|

|

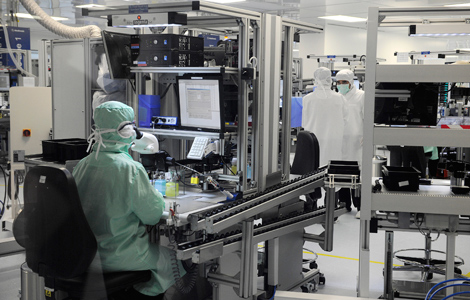

Medtronic Inc heart pacemakers in production at Medtronic Singapore Operations. The company has maintained an average annual compound growth rate of 26 percent in China over recent years. [Photo / Bloomberg] |

Jean-Luc Butel, executive vice-president and group president of Medtronic International (the company's overseas unit), told China Daily that the Minnesota-based company will strengthen cooperation with Chinese players probably through a series of joint ventures and mergers and acquisitions.

"They don't necessarily have innovative technology. They have good technology, they have good distribution ... then we do want to cooperate with them," said Butel. The company invested more than $220 million to set up a joint venture with Shandong Weigao Group Medical Polymer Co Ltd in 2008, in which the US medical-device provider holds a 51 percent interest. That joint venture, Medtronic's first outside the United States,has helped the company to enrich its product portfolio, enhance market coverage and expand research and development (R&D) capabilities.

In July, Medtronic acquired Salient Surgical Technologies Inc and Peak Surgical Inc for a total of $620 million to boost its surgical products portfolio.

Butel said Medtronic is to double its workforce to 2,000 employees in China in four years and all positions need people - from R&D engineers to sales staff. In March, the company opened its Asia-Pacific regional headquarters in Shanghai along with an R&D center. "The R&D center is at very, very early stage. It will serve China at first and eventually the global network," Butel said.

Medtronic has been maintaining an average compound growth rate of 26 percent in China over recent years. So far, China is the fastest-growing and fourth-largest market for the medical-device provider. Emerging markets make up 60 percent of Medtronic's international growth, while China represents 40 percent of those emerging markets in terms of revenue. "Could we grow faster (in China)? The answer is yes. But is it wise? The answer is no," said Butel.

He said that "it actually takes a lot of time to properly train doctors to perform surgeries in the most safe and efficient manner", given the sophistication and new technology inherent in Medtronic's products.

On the other hand, the product life cycle of high-tech medical care devices is very fast, about 24 months. How to find qualified, competent and ethical people to get latest knowledge of new products and let them train doctors are also challenges.

The company develops and manufactures devices and therapies to treat more than 30 chronic diseases including heart diseases, Parkinson's disease, urinary incontinence, chronic pain and diabetes.

"We could sell a lot of products to our distributors, that's our purpose ... but we need to build the foundation and need to make sure that our growth rate represents the safety of the patients," Butel said.

Medtronic introduced its newly developed pacemaker to China on Aug 1, the first one in the world made from new materials that allows patients to undergo magnetic resonance imaging with pacemakers made with new materials. According to a report from the South Korea-based Samsung Economic Research Institute, sales of medical equipment made up 12 percent of China's medical-care market in 2009, compared with 35 percent in the United States. Multinational companies control 80 percent of the high-end market, which accounts for 25 percent of China's medical-device market as a whole.

Sales of medical devices in China reached 61.4 billion yuan ($9.53 billion) in 2010, up 35.84 percent from 2009. The average annual growth of China's medical-device market is expected to be 30 percent in the coming years, the report said.