Statistics

Nation's copper imports decline 21% in Jan

(China Daily)

Updated: 2010-02-11 13:12

|

Large Medium Small |

HONG KONG: China's imports of unwrought copper and semi-finished products fell 21 percent on the month in January, much less than expected as traders turned to material in bonded warehouses to cover local demand.

While wary to read too much into 2010's first month, analysts said it could be an early signal that this year's imports would fall short of the record levels of 2009, as China's stockpiles get run down.

"I think this year's refined copper imports will be around 2 million tons, averaging less than 200,000 tons a month, much lower than 2009," said Liu Xu, a metal analyst at China International Futures.

"Last year, many traders and companies bought a lot and their stocks are high now."

The imports by China, the world's top consumer of copper, fell to 292,096 tons in January, reversing December's 27 percent rise, preliminary data released by the General Administration of Customs showed yesterday.

This was well short of expectations for over 400,000 tons.

"I am surprised imports fell so much from December given the arbitrage was not bad for much of the month," said Zhu Yanzhong, an analyst at Jinrui Futures, referring to a premium for local material over London Metal Exchange prices.

"I believe people took copper from bonded warehouses instead of buying from overseas since stocks in Asian LME warehouses did not fall much," said Zhu, who estimated January imports included 190,000-200,000 tons of refined copper.

London copper gave up early gains right after the lower than expected Chinese data, but bounced back later as traders focused on the likelihood of reduced stockpiles.

"The numbers are really choppy month-to-month but even 292,000 tons, if you wind the clock back a couple of years, would be taken as a really strong number," said David Moore, Commonwealth Bank commodities strategist in Sydney.

Bonded copper

Copper stocks in bonded warehouses in Shanghai fell by a quarter to around 150,000 tons in mid-January from a month earlier because merchants sold stocks in the spot market to cash in on strong Chinese prices, traders have said.

The copper that had arrived in Shanghai during the second half had built up in bonded warehouses, temporarily avoiding China's 17 percent value-added tax, because importers did not want to sell the metal at then weaker Chinese prices.

Bonded copper stocks in Shanghai have fallen further this month and strong demand for this material has driven up premiums to $125-$130 a ton over cash LME copper prices, compared with the country's major supplier Codelco's 2010 premiums of $85 to China, traders said.

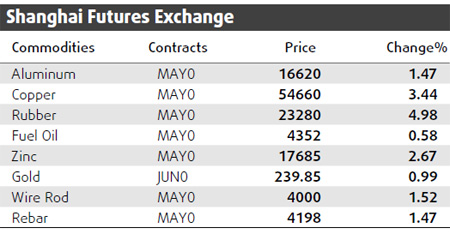

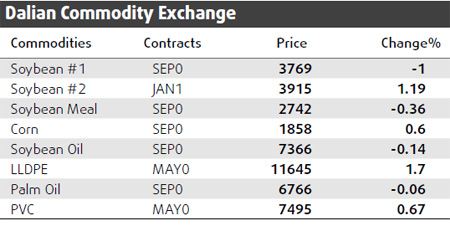

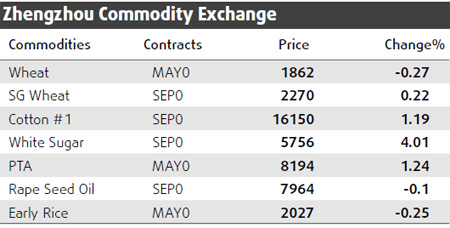

| ||||

Imports of unwrought aluminum and semi-finished products dropped 16.6 percent to 97,633 tons in January, extending December's 3 percent fall due to poor margins.

China is the world's top consumer and producer of primary aluminum. Its imports hit a record in the first half of last year after the government bought the metal for stockpiles.

Both imports of copper scrap and aluminum scrap, materials for fabricators, fell by a fifth in January from December.

Reuters