Top Biz News

Commodity, finance companies lead rally

(China Daily)

Updated: 2010-02-04 10:54

|

Large Medium Small |

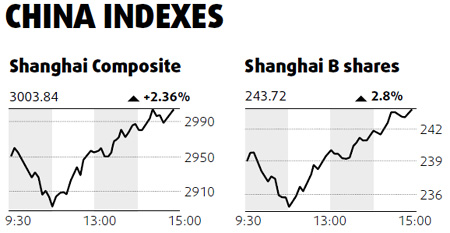

SHANGHAI: Mainland stocks advanced the most in six weeks, led by financial companies and commodity producers, as investors speculated recent losses that made the Shanghai Composite Index the world's worst performer were overdone.

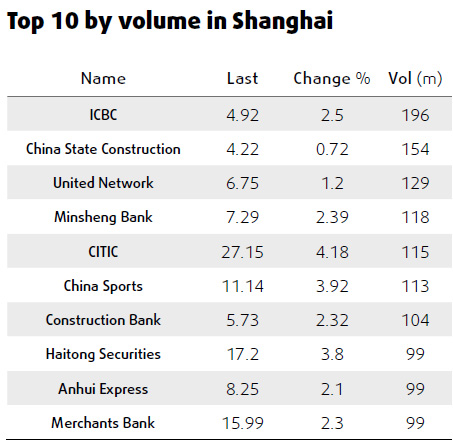

China Life Insurance Co rallied 3.1 percent, snapping a seven-day losing streak, and Industrial and Commercial Bank of China Ltd climbed 2.5 percent. Jiangxi Copper Co, China's biggest producer of the metal, jumped 6 percent and China Shenhua Energy Co gained 4.6 percent.

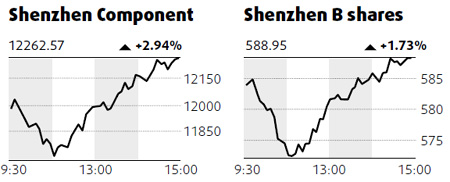

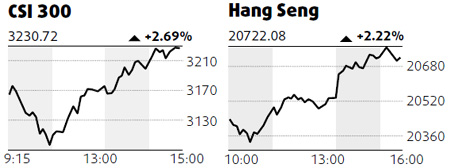

The benchmark gauge added 69.12, or 2.36 percent, to close at 3003.83, the most since Dec 24. The index fell yesterday at its lowest since Oct 12, capping a 10 percent annual plunge that was the worst among 94 global indexes tracked by Bloomberg, amid concern the government would step up measures to slow the economy. The CSI 300 Index gained 2.69 percent to 3,230.72.

"Investors who haven't invested in China should be doing so now if they have got a view that extends beyond two months," Christopher Wood, chief strategist at CLSA, said in an interview in Manila. "This correction, which may run for a top two to three months, is the opportunity to invest in banks, property, consumer stocks."

China Life, the nation's biggest insurer, rose 3.1 percent to 27.52 yuan. Ping An Insurance (Group) Co, the second largest, gained 5 percent to 49.83 yuan. Morgan Stanley assumed coverage of China insurance stocks with an "attractive view".

Industrial and Commercial Bank of China, the nation's biggest listed lender, added 2.5 percent to 4.92 yuan.

Hang Seng rises

| ||||

"The US data, alongside strong growth signals from China, point to a healthy trajectory for global growth," said Nader Naeimi, a Sydney-based strategist at AMP Capital Investors, which oversees about $90 billion globally. "That means ongoing demand for commodities, which is positive for Hong Kong."

The Hang Seng Index gained 2.2 percent to 20722.08 at the close, its steepest gain since Nov 30. The Hang Seng China Enterprises Index rose 2.3 percent to 11838.72.

Bloomberg News