Top Biz News

Copper gains on demand outlook

(China Daily/Agencies)

Updated: 2009-12-30 08:05

|

Large Medium Small |

London copper prices rallied almost 3 percent to a 16-month peak yesterday after the Christmas break, chasing gains made in Shanghai over the holiday period.

Strike votes at two large Chilean copper operations, Codelco's Chuquicamata mine and Xstrata's Altonorte smelter, are seen lifting sentiment as the year grinds to a close and investors assess what next from markets that have rallied around 140 percent this year.

"The strength in copper is likely to continue at least through January, as sentiment is very optimistic and so far there doesn't seem to be any major news that would alter the trend," Guo Yong, an analyst at Jinrui Futures, said.

| ||||

London Metal Exchange copper jumped 2.8 percent to $7,265 in early trade from Thursday's evening evaluation of $7,070, after a four-day hiatus.

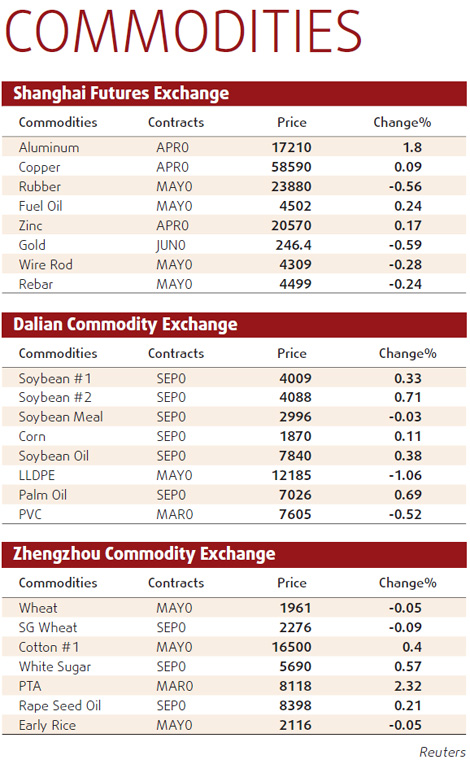

Benchmark third-month Shanghai copper rose 100 yuan to 58,360 yuan a ton at the close, having scored a 16-month peak in the previous session. The more-active fourth month, April, rose 60 yuan to 58,590 yuan.

Worries about the 42 percent rise in LME stocks and the 485 percent surge in inventories in Shanghai this year could be soothed a little after workers at the two large Chilean operations voted to strike.

The vote at Chuquicamata threatens output of around 4 percent of the world's copper concentrate, while the vote at Xstrata's Altonorte smelter could cut 1.5 percent of global output of copper anode.

"The Chileans have dealt a double blow to copper bears. These strikes will lift copper sentiment, but industrial action in Chile rarely lasts, so unless they are really dug in, it won't change the fundamentals much," a dealer in Singapore said.

Shanghai zinc dipped 30 yuan to 20,340 yuan, having scored a 20-month high in the previous session, while aluminum rose 1.1 percent to 16,980 yuan, and earlier hit a new 15-month peak of 17,030 yuan.

LME aluminum rose 1.1 percent to $2,280 from an evening evaluation of $2,255 on Christmas Eve, while zinc jumped 3.3 percent from Thursday's assessed value, to $2,578, retreating $10 from an earlier peak when prices hit their highest since mid-March 2008.