|

BIZCHINA> Review & Analysis

|

|

China not in search of money or power

By Yang Ning (China Daily)

Updated: 2009-11-26 07:50

He Maochun has changed roles with aplomb, from farmer to professor of economics, from sailor to government official, and from exporter who has traveled to 110 countries to a researcher on WTO. His present role is as director of the center of economics and diplomacy of Tsinghua University, Beijing. He is also a member of China Democracy League, a non-communist party, and an electrifying speaker. His favorite subject, as it is of most of his audience, is China's role in the future world. In just 10 years from now, the size of China's economy will be bigger than Japan's and get closer to that of the US. So, he says, "if you talk about the two greatest events in the 21st century, one has to be China's rise. And if you talk about just one, again it has to be China's rise."

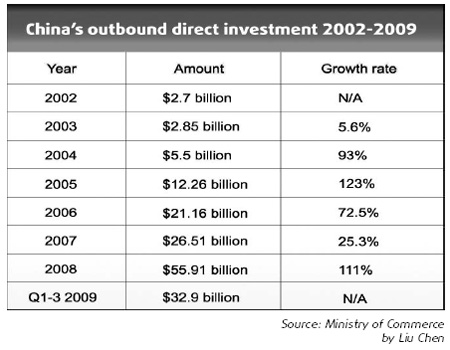

But He is not an ultra-nationalist, as his argument proves. "What is the purpose of China's rise? Let us think how can a superpower care only about itself? Our greatest glory will be (serving) mankind its common security its sustainable development." Speaking at a recent conference on cross-border investment in Beijing, he says it's time Chinese companies made offshore investment one of their priorities to expand, and helped China grow into a bigger power. Chinese have 55 trillion yuan ($8.05 trillion) in business and personal savings, the country has $2.2 trillion in foreign exchange reserves and last year, government revenue touched 6 trillion yuan ($878 billion). China is sitting on a huge amount of wealth, so "why don't we share it with the rest of the world?" he tells China Daily. That is how China can shoulder increasing responsibility in world affairs and Chinese companies can expand and become more efficient, he says. This is the best time for Chinese companies to "go out". But offshore investment should not be a game reserved only for State-owned enterprises. "It should also be open to private small- and medium-sized enterprises (SMEs)."

But isn't China's ODI coming too soon and too fast, especially because it does not have any experience of building modern businesses in distant lands? Shouldn't Chinese companies adopt a "go-out-but-go-slow" strategy to avoid blunders such as TCL's loss in its takeover of France's Thomson SA, a consumer electronic company, and Lenovo's attempt to expand its global sales after taking over IBM's personal computer division? (For more biz stories, please visit Industries)

|