|

BIZCHINA> Editor Choice

|

|

A new code of conduct

By Lu Haoting (China Daily)

Updated: 2009-09-07 08:05

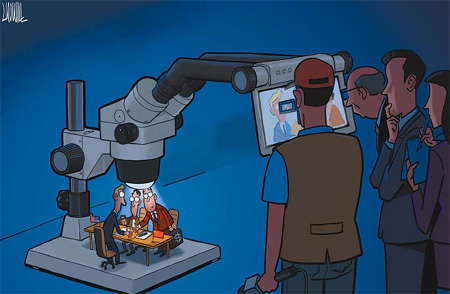

The Chinese government's probe into the Rio Tinto commercial spying case may not have a major impact on foreign companies' business investment decisions about China. But it renews questions about the boundary of multinational companies' acceptable commercial behavior in China, and the cost of crossing that line. Multinational companies that arrived in China in the early stages of its reform and opening are facing a different China now. These companies face a stricter regulatory environment, the phasing out of preferential policies toward foreign investors, a rising number of local consumers who fill online chat rooms with comments, and local media that are quick to pick up on foreign firms' blunders. "Multinationals have to deal with a different sophistication, not only with the government but also the media, customers, suppliers and the Internet," said Jorg Wuttke, president of the European Union Chamber of Commerce in China. The chamber has more than 300 members in the country. "Stakeholders are getting more informed, more sophisticated and sometimes more aggressive," Wuttke said. "Multinationals have to change their tune." Uncertainties

Four Shanghai-based employees of Rio Tinto were arrested in early August for allegedly bribing their way into obtaining information about Sino-Australian iron ore price talks. China is the world's largest iron ore importer. The four employees were detained in early July and were formally accused of the more serious crime of stealing State secrets. "Some foreign companies are a little worried about the wording on espionage and data information gathering," Wuttke said. "Many of us in business need a large amount of information that normally comes from publicly available sources to draw rather detailed conclusions after analysis. Some are now worried that if they find such information, will the authorities draw the conclusion they stole or purchased it somewhere," Wuttke said. Some foreign media reported that the Rio Tinto case elevated the uncertainty factor for foreign investors to do business in China. But Wuttke said the Rio Tinto case is "a selected singular case" that has no major impact on business investment decisions on China. "Multinationals certainly do not think about reconsidering China as an investment destination. I have not heard this once. The driver for foreign investment is market size and market access," Wuttke said. In the early 1980s, China was considered a cheap manufacturing center for foreign companies, and most products were exported to other countries. But with a double-digit annual economic growth rate and deeper consumer pockets in China, the country has emerged as a strategic market for multinational companies. While the credit crisis has dragged the global economy into the most severe economic maelstrom of the post-war era, the Chinese economy can still meet its GDP growth target of 8 percent this year and is expected to keep up the momentum next year, Fan Gang, director of the China National Economic Research Institute, recently told the media.

Fan attributed the strong economic growth to the government's 4 trillion yuan stimulus package, domestic consumption, and rising investments in the property and industrial sectors. The strong growth momentum in China is particularly important to multinational companies battling falling demand in other markets. The latest European Chamber Business Confidence Survey issued in July showed that 71 percent of chamber members believe China's economy is more resilient than Europe or other traditionally strong markets. Compared with three decades ago when the country was in desperate need of foreign capital and technology, the Chinese government is now "more sophisticated" in attracting overseas investment, said Victor Ho, partner for mainland and Hong Kong operations at the international law firm Allen & Overy. "It wants to direct foreign investment into certain areas while creating a more level playing field for Chinese and foreign companies," Ho said. (For more biz stories, please visit Industries)

|