|

BIZCHINA> Top Biz News

|

|

Sliding equities trigger decline in copper prices

(China Daily/Agencies)

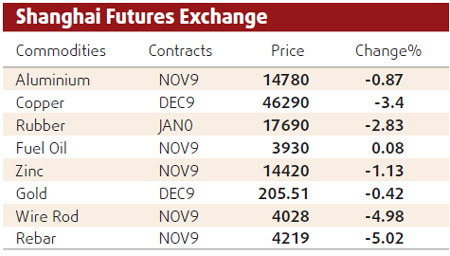

Updated: 2009-08-20 08:05 Copper prices fell yesterday, with Shanghai futures shedding more than 3 percent and London down by 2 percent under pressure from a slide in Chinese equities. Traders said a rapid 4-percent slide in the Shanghai composite stock index to a two-month closing low dragged Shanghai metals in their wake. Shanghai copper fell 3.3 percent to end at 46,560 yuan a ton, after touching 46,000 yuan. Copper for three-month delivery on the London Metal Exchange fell 2.4 percent to $5,935 in early trade yesterday, from an earlier high of $6,141. "The Shanghai stock market is falling and that is killing off appetite for metals," a trader in Shanghai said. "Consumers are already on the sidelines because they think prices are too high and this equity uncertainty means speculators are pulling out of metals too." Key contracts in the steel reinforcing bar and steel wire rod in Shanghai fell by their 5-percent daily limit, as spot prices tumbled. The November contract for reinforcing bar, or rebar, fell to 4,219 yuan a ton in early trade, compared with its settlement price of 4,442 yuan, while steel wire rod for November delivery fell to 4,027 yuan. In a note, Barclays Capital said a lot of positive news had already been priced in, and a rise in the dollar, a series of weak data from the developed world or a slowdown in China would harm the recovery in prices.

Some said the fall marks a long-overdue correction for metals prices. "We expect copper to decline further for the rest of the week, after it broke below the key psychological level of $6,000. This is the beginning of the downward correction," said Judy Zhu, analyst, Standard Chartered. "Supportive factors earlier, such as a rising US stock market and weaker dollar, have changed, boding ill for base metals." Shanghai aluminum also fell, losing 1.6 percent to 14,840 yuan. "China's aluminum market is still in surplus and we have plenty of inventory. Demand should be better this year than in 2008 but the market needs to spend some time running down the inventories," the Shanghai trader said. London aluminium fell $40 to $1,965, having risen 2.3 percent on Tuesday as investors weighed the risk to supply after UC Rusal said a dam accident could cost 500,000 tons in lost output, against record inventory levels. "If in this half a million tons of lost output is the case, it might be fairly serious for the market, but remember it's an unlisted company and it's in RUSAL's interest to get the price higher." "Maybe the owner wants to buy a football team. Another $200 a ton on aluminum would mean he could buy Chelsea," a dealer in London quipped.

(For more biz stories, please visit Industries)

|