|

BIZCHINA> Top Biz News

|

|

Prices continue drop, market pressure easing

By Si Tingting and Li Jing (China Daily)

Updated: 2009-08-12 08:48

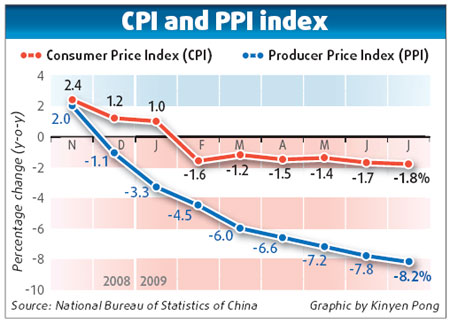

China's consumer prices continued to fall year-on-year last month, easing pressure for an early "policy exit" to prevent bubbles in the property and stock markets. The consumer price index (CPI), the main gauge of inflation, fell 1.8 percent in July while the producer price index was down 8.2 percent from a year earlier, Li Xiaochao, spokesman for the National Bureau of Statistics (NBS) said yesterday at a press conference. The July figures were anticipated by the market, where investors are waiting to see more signs of a solid recovery. The inflation figure marked the sixth consecutive negative growth, or the lowest point this year, and followed a decline of 1.7 percent in June. "The prices are falling year-on-year, and are falling at a faster pace. But the declining rate compared with the previous month is narrowed," Li said. The CPI declined at a fast pace from March to June, but the decline in July was only 0.1 percentage point lower than that of the previous month. Food prices, which account for one-third of China's CPI, are expected to show strength in the coming months, according to Jing Ulrich, chairwoman of China Equities at JP Morgan. "Grain price inflation, in particular, has remained positive throughout the downturn," she said. A surge in pork prices, which largely led the last round of a CPI surge in 2008, recently witnessed a slight increase. Pork is a staple for many Chinese. "Pork was only about 18 yuan ($3) per kg in May and June but is now sold for 22 yuan per kg," said a housewife surnamed Cui at a Wal-Mart supermarket in Beijing. The latest statistics from the Ministry of Agriculture show that the pork price has been rising for the past seven weeks. Cui borrowed an economist's line, saying that a relatively high pork price will keep pig farmers enthusiastic, while preventing pork prices from surging further because of a drop in supply. Pork prices peaked in 2008. Despite recent deflation, economists and analysts believe prices should begin to rise later in the year, with continued recovery in both the domestic and global economies. "When the major economies in Europe and the US recover, China's exports will go up right away and there will soon be signs of overheating," said Huang Weiping, an economics professor at Renmin University in Beijing. However, recent inflation readings have not dampened the surge in asset prices, which is a major factor behind the "bubble-in-formation" notion. The benchmark Shanghai Composite Index has rallied about 80 percent this year, while housing prices have returned to posting positive year-on-year gains.

Chinese lenders extended 355.9 billion yuan ($52.11 billion) of new loans, down from 1.53 trillion yuan in June, the People's Bank of China said on its website yesterday. Growth in China's broad M2 measure of money supply moderated to 28.4 percent in July. "After a period of record new loan creation banks have become more mindful of credit risk," Ulrich, of JP Morgan, said. Prominent Chinese officials recently reiterated the country's commitment to a "moderately loose monetary policy", and they also emphasized that the country will "fine-tune" growth in money supply and lending. Industrial output expanded by 10.8 percent in July from a year earlier, the NBS said. Earlier data showed it increased by 7 percent for the first half of 2009. Meanwhile, investment in urban fixed assets rose 32.9 percent in the first seven months of 2009 compared with the same period a year earlier, NBS said. It indicated a slight deceleration in July, given growth of 33.6 in the first half. Retail sales, the main measure of consumer spending, rose 15.2 percent in July compared with the same period last year, it said. The government is depending on consumer spending as a key factor in pulling the economy out of recession. "Today's avalanche of data suggests that the economic recovery is solid, but that the momentum ebbed in July," according to a report by Standard Chartered Bank (China). (For more biz stories, please visit Industries)

|

|||||