|

BIZCHINA> Top Biz News

|

|

Metals, banks trigger decline in share prices

(China Daily/Agencies)

Updated: 2009-08-06 08:05

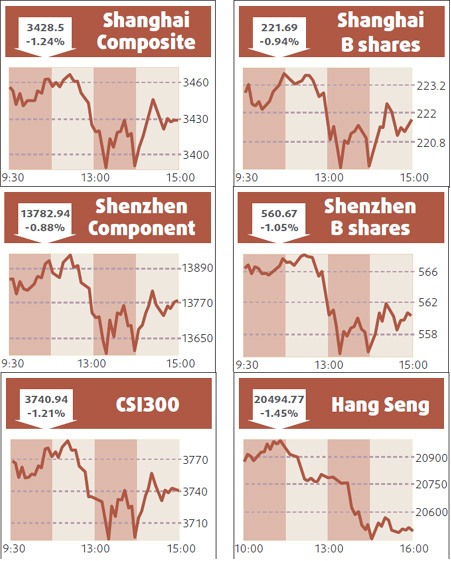

The mainland stocks fell for the first time in five days, led by commodities producers and banks, on concern the market's recent rally has made the nation's equities too expensive. The Shanghai Composite Index fell 42.94, or 1.2 percent, to 3428.5 at the close, snapping a four-day, 6.3 percent advance. The CSI 300 Index slid 1.2 percent to 3740.94. "With shares so expensive, I doubt there will be much room for the upside," said Yan Ji, who helps oversee about $850 million at HSBC Jintrust Fund Management Co in Shanghai. "We have yet to see corporate earnings turn around." The Shanghai gauge has gained every month this year, doubling from last year's low, as record bank lending and government stimulus spending spur a rebound in the economy. Shares on the index trade at 37.3 times reported earnings, near an 18-month high and twice the level of emerging markets. Individual investors opened 700,617 accounts to trade stocks last week, the most since January 2008, according to data from the country's clearing house. Stocks may slump by as much as 18 percent within the next three months, Carter Worth, chief market technician at Oppenheimer & Co, said this week. "The market does not go higher from here," Worth said. "There has been virtually no pullbacks and it needs to pull back to be healthy." Jiangxi Copper Co, the nation's largest producer of the metal, dropped 2.2 percent to 46.60 yuan. Industrial Bank Co fell 3.8 percent to 39.91 yuan, its biggest retreat in a month, after almost tripling in 2009, while Poly Real Estate Group Co slipped 2.7 percent to 26.44 yuan. Hang Seng down

Shares in Cathay Pacific tanked 3.6 percent even after the airline announced its return to profit as it decided not to pay an interim dividend. The benchmark Hang Seng Index finished 301.66 points lower at 20494.77. The gauge failed to hold above 21000 points after breaking through that level for the first time in 11 months on Tuesday. Investors turned wary as valuations of blue-chip stocks inched closer to 21 times their estimated earnings in 2009. The China Enterprises Index, which represents top locally listed mainland Chinese stocks, was 2.1 percent lower at 11968.48.

(For more biz stories, please visit Industries)

|