|

BIZCHINA> Top Biz News

|

|

Shares edge up led by energy producers

(China Daily/Agencies)

Updated: 2009-07-23 07:57

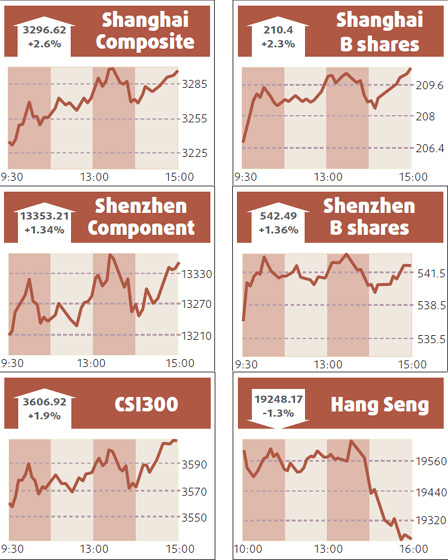

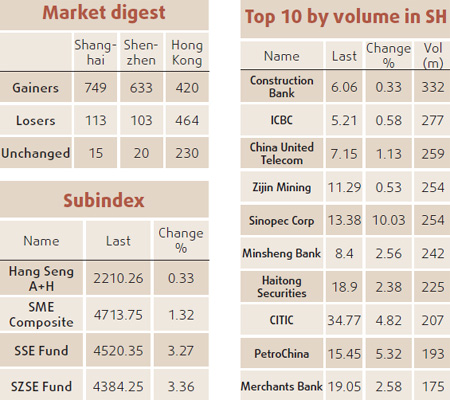

China's stocks rose, rebounding from the Shanghai Composite Index's biggest drop in five weeks, as energy producers gained on expectations an economic recovery will boost power demand and bolster earnings. China Petroleum & Chemical Corp, also known as Sinopec, jumped the daily 10 percent limit to 13.38 yuan ($1.96), the most in four years, after Nomura Holdings Inc said first-half profit at the oil refiner may more than triple. PetroChina Co, the nation's biggest oil company, added 5.3 percent to 15.45 yuan, while China Shenhua Energy Co surged 4.5 percent to 36.67 yuan. The three stocks accounted for more than half the benchmark index's gain yesterday. The Shanghai Composite rose 83.41, or 2.6 percent, to 3296.62 at the close, its highest since June 2008 and erasing Tuesday's 1.6 percent drop.

"The market has high hopes of an economic recovery which will boost demand for energy," said Wang Zheng, a fund manager at Jingxi Investment Management Co in Shanghai. "Corporate earnings will improve but this is already fully priced in." The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, gained 1.9 percent to 3606.92. An index of 23 energy companies on the CSI 300 has risen 137 percent this year, the most among the 10 industry groups. It added 5.6 percent yesterday, its largest advance since May 4. Hang Seng drops Hong Kong stocks fell, erasing gains, as Morgan Stanley advised investors to "sell into" the global rally in equities, and on speculation HSBC Holdings Plc may report lower earnings. HSBC, Europe's biggest bank, declined 2.2 percent. Li Ning Co slipped 6.8 percent after its chairman sold shares in the sporting goods retailer. The Hang Seng Index slumped 1.3 percent to close at 19248.17, after climbing as much as 0.7 percent. The benchmark index has soared 70 percent from a more than four-month low on March 9 amid speculation stimulus efforts worldwide will revive global growth. "There should be some profit taking after the rally," said Louis Wong, a fund manager with Phillip Securities HK Ltd. The Hang Seng China Enterprises Index lost 1 percent to 11481.3.

(For more biz stories, please visit Industries)

|

|||||