|

BIZCHINA> Top Biz News

|

|

They're catching 'em apartments young and fast

By Wang Ying (China Daily)

Updated: 2009-07-11 07:13

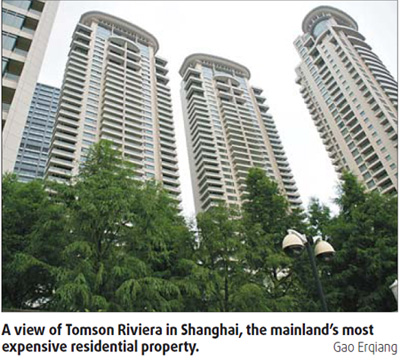

Catch 'em young, goes the phrase. But in Shanghai, it's the young that have caught the realty market by surprise. Three 20-somethings left the city's housing market perplexed recently after buying a luxury apartment each in Tomson Riviera, considered the most expensive on the Chinese mainland. Tomson has sold 16 units in its block C in the past two weeks, Li Qin, a senior company employee, said. "Each of these 431.89-sq-m houses fetched 98,000 yuan ($14,370) per sq m." A list with Lu Qilin, director of Shanghai-based Uwin Real Estate Research Center, shows four of the 12 buyers are four from Shanghai, two from Guizhou province, one each from Hong Kong and Taiwan and the rest from foreign countries. Nothing surprising there, except that three of the buyers were born after 1980, with the youngest - from Taizhou in Zhejiang province - still being in his late teens. "Obviously, these young buyers are just representing their super wealthy families," an analyst said. "But this is a signal that the wealthy people are coming back to the property market and the industry is on the rise." Apart from Tomson's sales boom, three other luxury apartments were sold in Shanghai's Pudong New Area, the Shanghai-based Oriental Morning Post said.

The unprecedented sales boom is not speculation, Liu said. "During the last three years, the average price of apartments in Shanghai has risen by 50 percent. But Tomson's price has stayed almost unchanged." "I'd rather see this as the market accepting Tomson's price," Lu said. The global economic crisis doesn't seem to have dampened the buying power of China's nouveaux riche, said Chen Sheng, director of China Index Academy. Instead, there appears to be a lot of low-cost investment opportunities for them. Property being one of the most steady investment tools will attract a growing number of investors, Chen said, especially because the supply of luxury apartments is limited. "I'm not implying that inflation is round the corner ... even without inflation, high-end property is the best investment choice to maintain the value of assets." (For more biz stories, please visit Industries)

|