|

BIZCHINA> Review & Analysis

|

|

Time to aim for better balance in growth

(China Daily)

Updated: 2009-06-25 07:19 Q: What are your suggestions on reforming the yuan exchange rate regime in the near future? What if China switches its dollar-denominated foreign reserves to the euro?

A: By moving in mid-2008 from the newly flexible regime - which indeed appears to have put roughly equal weight on the euro and the dollar in 2007 - Chinese policymakers are almost back to the dollar peg. My answer to the question about the future is that it seems likely that the Chinese authorities will once again jump off the dollar-peg horse. One might expect pressure from Chinese exporters to increase because they have been hit hard by the recession. On the other hand, US congressmen, Democrats and Republicans both, are still pressing for loosening the link with the dollar. They are oblivious to the fact that the yuan would probably be weaker today if the Chinese authorities had retained the 2007 regime or if they had loosened the dollar link in some other way. The question about how to hold reserves is different. The People's Bank of China (PBOC) feels there isn't an alternative to the dollar, and it knows that if it started selling dollars the US currency would probably fall sharply, which would hurt China the most. But there are options: especially the euro and some smaller currencies, and even gold and the self-drawing right if the international community accords it a larger role to play. When other dollar-holders start selling the greenback, however, the PBOC wouldn't like to be the only central bank left "holding the bag". Q: Princeton Professor Gregory C. Chow and Stanford Professor Ronald McKinnon held a debate in 2005 on whether a revaluated yuan would be good for the Chinese economy. But you have suggested that revaluation of the currency is not the only policy change China needs to make. Can you elaborate on that? A: Prof Chow was clearly right, at least for the period between 2005 and 2008, when overheating and inflation were clearly a bigger danger than deflation. Like every other country China has moved to the recession or disinflation side of internal balance since mid-2008, so that particular reason for revaluation of the yuan is no longer there.

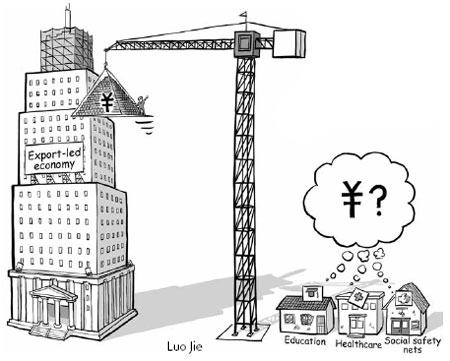

But that doesn't mean I share Prof McKinnon's general fondness for fixed exchange rates. There are still other reasons on the list why China should allow greater flexibility (which, incidentally, under present conditions may no longer imply raising the yuan's value). My statement that a change in exchange rate policy is not the only policy change that China should make is truer today than when I made it. What China should do - and, in fairness, has apparently begun to do - is expand domestic demand and shift the economy structurally toward such neglected sectors as healthcare, education and the environment, and more generally to build social safety nets and expand the service sector. The industrialization model led by exports of manufactured goods has accomplished miracles in China, but the time has come to achieve a better balance by developing the rest of the economy. And that will need the government to increase spending. This interview is part of a project called "China in the Eyes of Harvard - Interviews with Experts on China Issues at Harvard". More than 40 prominent Harvard professors have been interviewed, and their views would be compiled into two books. The China Social Sciences Press will publish the Chinese version, and Harvard University Press, the English. (For more biz stories, please visit Industries)

|

|||||