|

BIZCHINA> Top Biz News

|

|

Dairy firms make new moos

By Ding Qingfen (China Daily)

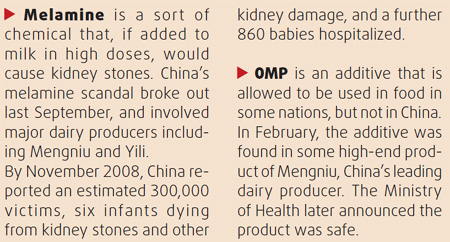

Updated: 2009-06-15 08:06 China's dairy sector is struggling to claw its way back from the debilitating effects of last year's tainted milk scandal that saw one producer go bankrupt, losses at several others and an industry reputation in tatters. The melamine-tainted milk scam claimed the lives of six infants and hospitalized nearly 300,000 others in 2008. The incident forced dairy firms to take their products off the shelves and go into damage control mode, chiefly by way of crisis marketing and quality control. The industry, which had witnessed a 20 percent growth rate over the past decade, also reported deep losses.

Yili incurred losses of 1.69 billion yuan; Bright Dairy lost 286 million yuan. Only Sanyuan Food, one of the few producers to escape the crisis, made a profit of 40.76 million yuan in 2008. Investors too shunned the industry. Yili and Mengniu shares nose-dived. Yili dropped to 6 yuan from 17 yuan, while Mengniu fell to HK$6.4 from HK$24 last August. Bright Dairy shares went down to 3.2 yuan last December from 7.6 yuan in September 2008. And, in February this year, Sanlu, which was at the heart of the scandal, declared bankruptcy, leaving a dairy market worth 10 billion yuan for other players to grab. Shaking up

Now, the industry is going through a shake-up of sorts. Sanyuan Food, a regional brand name in Beijing and Hebei, is gearing up to be a national player after it purchased Sanlu's key assets. Many other regional players are also looking at expansion, although analysts contend that the top two producers, Mengniu and Yili, cannot be replaced that easily. The industry is also focusing on bettering the source quality of dairy products. Yili is developing a new cow community model, and plans to organize 20 such communities by the end of 2009. Each community houses 1,000 cows collected from local farmers. Yili is entrusting a professional company with the task of raising the cows to make sure the milk is safe. "2009 will be the year of quality. Quality means life," Zhang Jianqiu, Executive President, Yili told China Business Weekly. Rebuilding reputation is not a milk run "Quality control will be given top priority," said Yang Wenjun, president of Mengniu, Yili's chief rival and China's top dairy producer. "We must win back consumer confidence rapidly. We cannot let them down any more." Mengniu plans to increase the number of its mega-sized pastures, each of which can house up to 10,000 cows, to 20 in the next three years from nine currently, he said. For Yang, the past eight months have been the busiest in his life. "For months, I worked for at least 12 hours a day. Everyday, I was traveling around, meeting, negotiating and doing a lot of chores that I wouldn't have touched before," he said. The last quarter of 2008 was the most difficult, according to Yang. "Sales were sluggish and there were piles of inventory in the warehouse," he said. Yili's Zhang said many of his company employees, including the top brass, volunteered to go down to supermarkets during weekends to promote sales and to communicate with consumers. "There were thousands of complaints, but it was understandable," he said. These efforts seem to be paying off, finally. By the end of April, Mengniu had recovered about 90 percent of its earlier sales volume, Yang said, although "this year will continue to be hard; Mengniu may not be able to shrug off the effects of the scandal until the end of next June". In late April, Yili too reported first quarter profits had soared by 104 percent from a year earlier, to 113 million yuan. Mengniu executives said the company was likely to make a profit of 700 to 800 million yuan this year. Share prices of Yili, Mengniu and Bright Dairy have also gone up since ealry this year. Last Friday, Yili and Bright Dairy closed at 15.5 yuan and 7.04 yuan at the Shanghai Stock Exchange, and Mengniu closed at HK$19.26 at the Hong Kong Stock Exchange. However, "it will take months for the sector to get back on its feet; it may only happen by the first half of 2010," Wang Dingmian, executive council member of the Dairy Association of China, told China Business Weekly. "Our biggest concern is how to regain consumer confidence as soon as possible." The biggest plus point for dairy producers is China's huge untapped dairy market. Every Chinese citizen on average consumes 30 kilograms of dairy products annually, much less than the world average of 120 kg and 300 kg for developed nations. The 1.3-billion Chinese population is estimated to require dairy products of between 117 and 351 billion kg every year. These numbers, despite the scandal, spell good news for dairy producers. "China's huge consumption potential requires that local dairy producers grow significantly. That will come as a major boon for the industry," Long Yongtu, Bo'ao Forum's secretary-general for Asia, said recently. Potential market That means there is huge scope for expansion and consolidation in the sector. And many companies are doing just that. New Hope Dairy, a brand in China's western region, is establishing manufacturing bases in Zhejiang and Anhui in eastern China. Hangzhou Wahaha Group, a leading beverage maker, announced late last year that it would enter the dairy sector. Earlier this year, Bright Dairy, for the first time introduced dairy products that could be kept at room temperatures. It has developed 1,400 distributors for these products in 500 cities. Guo Benheng, the company's president, was also reported as saying that Bright Dairy was thinking of buying some powerful regional brands, with negotiations now under way. Sanyuan Group, the parent of Sanyuan Food, has also turned into a leading agricultural group by purchasing two Beijing-based poultry enterprises last month, which, according to Zhang Fuping, the chairman of the new entity, would help sharpen its competitiveness in R&D, marketing and logistics. "Bright Dairy and Sanyuan Food are definitely potential candidates to grow stronger," said Chen Yu, a senior dairy analyst and professor at the Institute of Cadre Management under the Ministry of Agriculture. Yet, they are much smaller in size compared to the industry leaders. Mengniu and Yili posted sales worth 23.86 billion yuan and 21.66 billion yuan, respectively, in 2008. Bright Dairy's sales were only 7.36 billion yuan. As for Sanyuan Food, sales would touch 11.41 billion yuan only if Sanlu's sales of 10 billion yuan for 2007 were to be included. During the first quarter of 2009, Sanyuan earned a profit of 32.32 million yuan, one third that of Yili's, at 113 million yuan. "It will take no less than five years for them to reach the level of Mengniu and Yili," Wang of the Dairy Association said. It is not only about size, marketing and R&D, but more importantly, a "professional team that could map out the right strategy," said Yang of Mengniu. Bright Dairy and Sanyuan Food, being State-owned entities, were less efficient in management and strategy implementation, he said. "Professionalism is the key to becoming the leader," Yang said. The government too has done its part. It has taken a series of measures, such as drafting guidelines to tighten and standardize the industry. Under the norms, relevant laws will be strengthened or revised to ensure that dairy source quality is safe for processing, and that manufacturing is stringently checked for quality. "If they had taken such steps years ago, the scandal would have never happened," said Chen. For years, too many organizations were responsible for the supervision of the dairy sector. As a result, "nobody knew what they respectively had to do and there were many loopholes with the management system. The crisis compelled them to rethink, and about how to coordinate," Chen said.

(For more biz stories, please visit Industries)

|

||||||