|

BIZCHINA> Top Biz News

|

|

Financial shares lead market fightback

By Yang Zhen and Zhou Yan (China Daily)

Updated: 2009-04-10 07:49

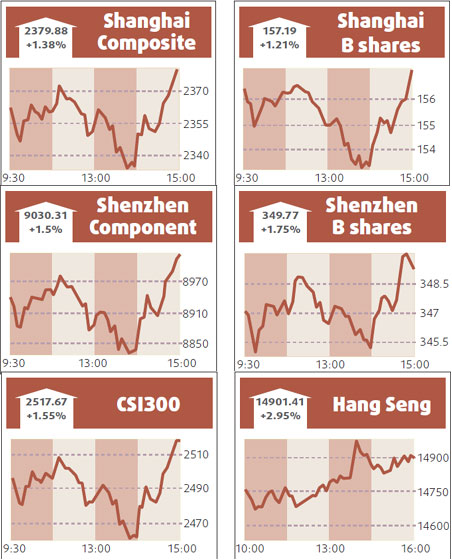

Financial shares, led by Ping An Insurance and Shanghai Pudong Development Bank, fueled the rally in the mainland stock market to end a two-day losing streak. The benchmark Shanghai Composite Index rose 1.38 percent to end at 2379.88 points yesterday after posting its biggest daily percentage drop of 3.8 percent in more than a month the day before. Shares of Ping An Insurance, the world's second-largest insurer by market value, climbed 5.95 percent yesterday, its largest one-day gain since a 10 percent surge on March 4, boosted by speculations on a new stimulus package from the central government. Its closing price of 41.1 yuan a share was also the highest since the outbreak of the global financial crisis. Its previous high was 41.9 yuan on Sept 11, 2008.

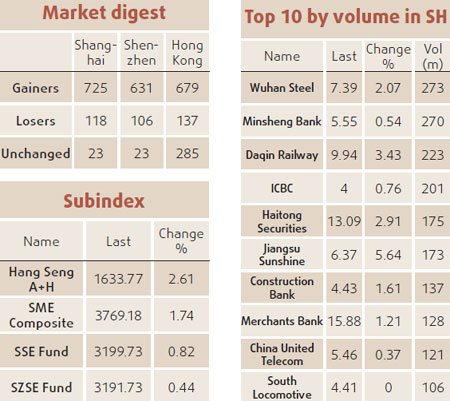

Another strong performer yesterday, Shanghai Pudong Development Bank (SPDB), advanced 5.21 percent 22.03 yuan, also its highest one-day gain since rising to the 10 percent daily limit on March 4. The mid-sized Chinese bank is due to release its 2008 earnings report today. Expectation of strong profit growth has boosted investor confidence in the bank, analysts said. SPDB issued its preliminary earnings report, which estimated a whopping 127.53 percent jump in 2008 earnings to 12.5 billion yuan. The Diversified Bank Index, which covers the shares of the 12 listed banks on the Shanghai bourse, rose 1.62 percent to 1809.36 points. Index heavyweights Industrial and Commercial Bank of China and China Construction Bank surged 0.76 percent and 1.61 percent, respectively. The Shanghai Stock Exchange and China Securities Index Co will launch a mega-cap index on April 23 covering the most heavy-weighted enterprises publicly traded on the Shanghai bourse. The index includes 20 blue-chips with a combined capitalization of 6.16 trillion yuan, accounting for 49 percent of the total market value of Shanghai-based A shares on Wednesday, SSE and CSI said in a joint statement. Agencies contributed to this story

(For more biz stories, please visit Industries)

|

|||||