|

BIZCHINA> Top Biz News

|

|

Inject less to IMF, China cautioned

By You Nuo and Fu Jing (China Daily)

Updated: 2009-03-17 07:43

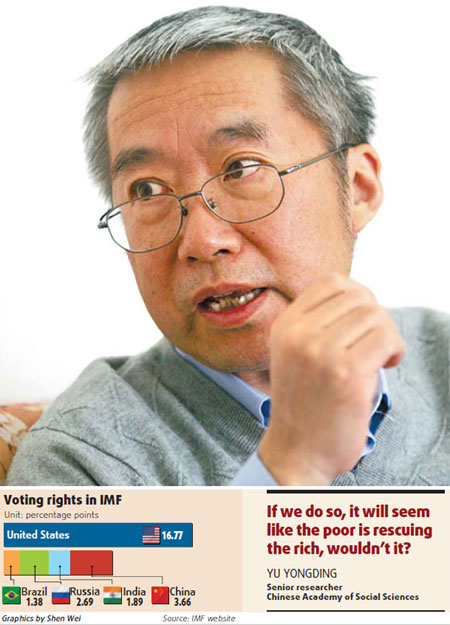

China should not give huge capital subscription to the International Monetary Fund (IMF), which is planning to offer a helping hand to some European countries struggling due to the economic crisis, a top economist warned. "With regard to offering subscription to the IMF, I personally believe that we can do (that) symbolically and not lend huge amounts," Yu Yongding, president of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences told China Daily yesterday in an exclusive interview ahead of the G20 London Summit next month.

"They (developed countries and pressure groups) have already targeted our wallets but we have many reasons to object," said Yu, a formal central bank advisor. First, China is ranked 100 out of 192 UN members in terms of per-capita GDP despite the fact that it is the third biggest economy in the world after the US and Japan. Many of the troubled countries that IMF wants to rescue have a per capita income that is much higher than the average Chinese. They have also enjoyed at least one decade of economic prosperity and their living standards are still far higher than China's. "If we do so, it will seem like the poor is rescuing the rich, wouldn't it?" said Yu. Second, Yu said the countries on the IMF rescue list, especially some from Europe, have an anti-China mentality. "Their pitches are even higher than some Western countries sometimes when they protest against China," said Yu. "We have no reason to help them." Yu said the Chinese public would also not agree to such measures. He added that China's friends in the developing world have cautioned against giving capital subpscription to the IMF. "Even if you do decide to do so, the sum should not be big," Yu quoted them as saying. "Even if China decides to inject a large sum of money, it is pointless to increase its weight in the international financial organization," said Yu. This is because the US still holds veto rights in the decision-making process of the IMF. "The most substantial step, if any, should be the removal of the US' right to veto," said Yu. "But it's a difficult task." Currently, developed economies dominate international institutions. For example, the voting rights of the BRIC countries, Brazil, Russia, India and China, in the IMF are 9.62 percent of the total, together accounting for about half of the voting rights that the US holds. At the recent summit of the G20 finance ministers and central bank governors, the next review of IMF quotas is likely to be completed by January 2011. The meeting also agreed to increase the representation of emerging countries in international financial organizations. Yu, however, said China's reputation in the international community would be enhanced if it does inject the huge amounts. It would also contribute to the stabilization of world economy, he said. "At the coming G20 summit, China's leadership should take a decision to do, or not to do," said Yu. (For more biz stories, please visit Industries)

|