|

BIZCHINA> 30 Years of Reforms

|

|

Related

Country grapples with runaway property prices

By Hu Yuanyuan (China Daily)

Updated: 2008-08-19 11:36

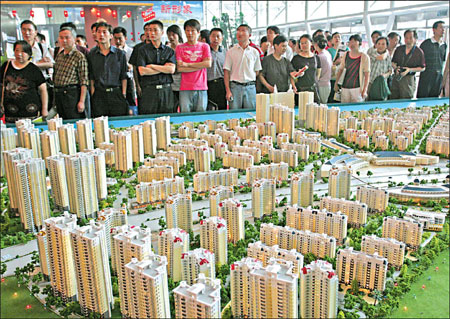

For most Chinese, owning a house is as much a necessity as it is a dream. And, for the Chinese government, making more houses available for the common people is one of its policy priorities.

The residential housing market now accounts for more than 70 percent of all property development in China. But only 10 years ago, the vast majority of people lived in housing provided by their work units, often in cramped conditions. The housing reform program introduced in the late 1990s has encouraged greater participation by the private sector, resulting in a huge increase in supply. Many homebuyers are taking advantage of the widening availability of bank financing to acquire their first homes.

As a result, per capita living space in urban areas has risen from 16 sq m per person nationwide in 1995 to 28 sq m per person in 2007, with hundreds of millions becoming homeowners, according to the National Bureau of Statistics. Homebuyers' soaring demand has been fueling a real estate boom in China for years, but has also sent property prices skyrocketing. To tackle speculation and cool down the sizzling property market, the government has ushered in a number of measures since 2005, including the introduction of new taxes on sales and capital gains and higher interest for mortgage lending on second homes. Meanwhile, the government has become increasingly concerned by the volume of funds seeking real estate investments in China, particularly the "hot money" entering the market looking for short-term gains. To deal with this, the government has, over the last several years, introduced a series of new regulations aimed at foreign investors in real estate. Foremost among these is perhaps Circular 171 that requires overseas investors in completed buildings to establish an onshore wholly foreign-owned enterprise or a joint venture before investing. This makes life difficult for foreign investors, but the potential returns from real estate investment in China are still exciting enough to keep investors streaming in. The economic fundamentals are still strong and there are opportunities across a range of sectors and in a range of geographical locations. (For more biz stories, please visit Industries)

|