Foreign JVs eye slice of pie

Updated: 2011-12-09 08:09

By Xiao Li (China Daily)

|

|||||||||||

In 2011, JP Morgan Chase & Co and Morgan Stanley formed joint-venture firms in China and their senior executives have expressed optimistic views about the outlook of China.

"This is a platform," Zili Shao, chairman and chief executive of JP Morgan China, was quoted by the New York Times as saying. "We must have this capacity or else our franchise will have a gap in the firm's global offerings."

JP Morgan's securities joint venture with Shenzhen-based First Capital Securities Co has got off to a good start, Zhao said in October. The joint venture, which began operations in June, allowed JP Morgan to enter the Chinese securities market. It already has some equity and debt underwriting deals in the pipeline, he said.

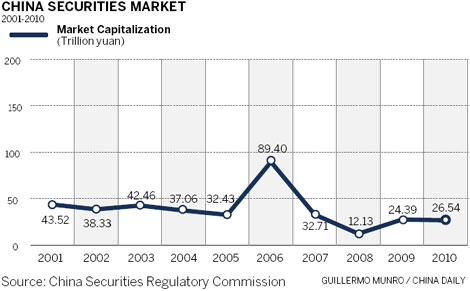

To illustrate how lucrative the Chinese market can be, CITIC Securities Co Ltd, the country's largest brokerage by market value, earned 10.9 billion yuan in net profit in 2010, even though the country's stock market was among the worst performing that year.

The 106 securities brokerages together earned about 108.5 billion yuan in net income from the underwriting business in 2010, according to the China Securities Association.

Analysts said that domestic firms should be well prepared for the competition from foreign financial institutions that are looking to expand their presence in the Chinese market.

"If they are not well prepared for the inflow of foreign investment in the domestic securities industry, they will gradually lose their market share," Fang Xinghai, director of the Shanghai Financial Services Office, was quoted by Chinese media as saying.

"Therefore, China should accelerate the reform of the financial industry and actively open its market," Fang said.

"Domestic financial institutions should grow along the trend of Chinese companies going abroad."

Related Stories

Listed securities firms see profit slide in August 2011-09-10 10:42

Brokers set to bounce back 2010-08-04 14:33

JP Morgan Chase aims to boost Chinese presence 2011-11-16 10:51

China OKs JPMorgan, Morgan Stanley joint ventures 2011-01-07 13:21

- Chinese shares close lower after data release

- Passengers prepare for annual peak

- Home appliance sales in rural China up 66% in Nov

- Collective wage talks promoted

- Good things in store for Chinese life insurers

- Dotcom could fall into disuse

- Global supermarkets conquer China

- China's Nov CPI up 4.2%, PPI up 2.7%