Foreign JVs eye slice of pie

Updated: 2011-12-09 08:09

By Xiao Li (China Daily)

|

|||||||||||

In 2002, Changjiang Securities signed an agreement with French bank BNP Paribas to set up a joint-venture securities company, which was the first joint-venture brokerage established after China entered the WTO. But three years later, the brokerage dissolved because of disagreements over strategy.

The China Securities Regulatory Commission (CSRC) introduced rules in June 2002, which set the maximum foreign stake in a Chinese brokerage at 33 percent.

In the following years, UBS, Goldman Sachs, Credit Suisse and Deutsche Bank each formed a Chinese joint venture with a local securities firm by holding a minority stake.

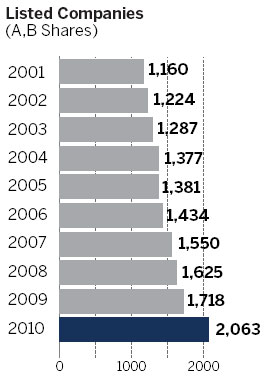

Despite the local market restrictions, foreign investment banks are eager to expand in China, the world's second-largest economy with a capital market that raised about $72 billion in IPO deals in 2010, which was more than the Hong Kong and New York stock exchanges for the first time.

However, the Chinese securities regulator has been cautious about foreign investment banks setting up joint venture firms in China.

"Foreign securities firms have to show their genuine interest in the Chinese financial industry when they seek cooperation with their Chinese counterparts," said Shang Fulin, former chairman of the CSRC earlier this year at a conference in Beijing.

"We will not allow any kind of stake holding by foreign investment banks of unlisted Chinese brokerages purely for the purpose of financial investment." he said.

However, despite the huge hurdles they face, foreign banks have not given up on the lucrative Chinese market, and the launch of the international board in Shanghai will help provide more business opportunities for joint-venture securities firms in Chinese A-share market, according to analysts.

The international board will allow foreign companies to float shares on the Chinese stock markets and the so-called red-chip companies that are listed overseas are also eyeing a return home.

"It definitely means more underwriting business for the brokerages, especially the joint-venture ones who have more experience in cross-border deals," said Zhang.

Related Stories

Listed securities firms see profit slide in August 2011-09-10 10:42

Brokers set to bounce back 2010-08-04 14:33

JP Morgan Chase aims to boost Chinese presence 2011-11-16 10:51

China OKs JPMorgan, Morgan Stanley joint ventures 2011-01-07 13:21

- Chinese shares close lower after data release

- Passengers prepare for annual peak

- Home appliance sales in rural China up 66% in Nov

- Collective wage talks promoted

- Good things in store for Chinese life insurers

- Dotcom could fall into disuse

- Global supermarkets conquer China

- China's Nov CPI up 4.2%, PPI up 2.7%